Investing In Your Child’s Future

As a recent college graduate, I am all too familiar with the high costs associated with obtaining a higher education. Tuition, room and board, and over-priced text books are only a few of the expenses every college student encounters, not including a budget for extracurricular activities. However, I am definitely not alone in my recent experience, with approximately 68% of 2014 high school graduates enrolling in colleges or universities nationwide1, the majority of American families with high school graduates are also facing the fact college has become expensive.

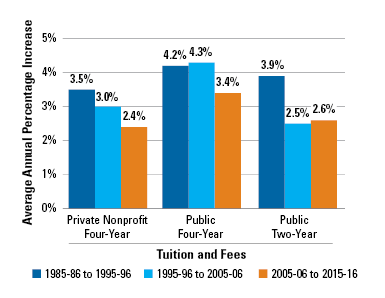

Obtaining a college degree has become a near necessity for young adults entering a competitive work force. With limited alternatives, the costs of higher education continues to increase, along with the anxiety families must cope with while saving for this expense likely 18 years in advance. Over the past decade, tuition at a public four-year university has risen to 3.4% per year above inflation2. The costs for public and private universities have continuously risen over the last 30 years, as evidenced in the chart below (College Board Organization2).

Suppose your family is due for a newborn this year (congratulations)! Naturally, you begin planning for your child’s future college expenses 18 years from now—beginning in 2034. What will the financial impact be on your family? The average cost of a public four-year university for in-state students today is approximately $9,410/year 3. Using the average annual increase in tuition of 3.4% adjusted for a historical rate of inflation, your child’s college education in 2034 is projected to be approximately $30,580 per year at an in-state public university. If your child graduates on time, this is over $120,000 in tuition costs for a four-year education. However, this total accounts only for in-state tuition and does not include other associated expenditures like room, board, and textbooks. As a recent graduate myself, believe me when I say, college has a way of creating many unforeseen expenses, especially for us out-of-state students (sorry Mom and Dad).

We all know college is expensive. However, what many families do not understand is how to effectively save money for their child’s education. At Avier Wealth Advisors, we recommend our clients use a state-sponsored 529 Educational Savings Plan; such as the Utah Educational Savings Plan (UESP). One major benefit of choosing a 529 plan is the flexibility it offers. For example, if a family’s permanent residence is in Washington and they invest the UESP, the child has the ability to attend college in any state, making 529 plans appropriate for any family across the country. Much like the structure of a Roth IRA, the funds are allowed to grow tax-free, meaning you will not have to pay taxes on any gains qualifying as education expenses. Some states, like Oregon, offer residents tax deductions for investing in the state 529 plan of their primary residence. In cases like this, it is important to weigh the program’s fees against the tax deductions received from the state. In the absence of a state tax benefit, we often recommend investing the UESP due to its overall low cost.

When it comes to the investment options within the UESP, investors have the ability to choose from many low-cost options, including Dimensional Funds. Paying high internal fees is the last thing you should do when saving for your child’s education and small percentages saved today result in greater earnings later. This corporate-wide belief underscores why we as a firm do not bill our clients’ assets earmarked for their children’s college funds. Another important benefit of a 529 Plan is the assets receive preferential treatment by Federal Student Aid (FAFSA), the government agency in charge of determining financial aid eligibility. FAFSA has determined a maximum of 5.64% of assets held in a parent-owned 529 are expected to be contributed towards college expenses, compared to 20% of assets owned by the student. This means the assets held within the 529 will not have a large detrimental effect on financial aid compared to assets held by a minor.

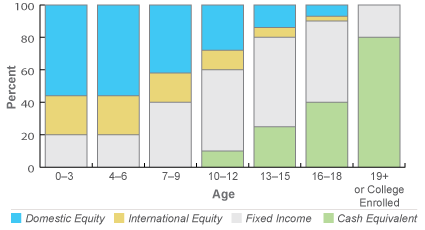

Although individuals have the freedom to invest in a number of ways within a 529 plan, we believe an asset allocation that follows the “glide path” formula offers investors optimal results. In the same way that client portfolios tend to become more conservative as they age, the “glide path” investment strategy automatically reduces risk in the portfolio as your child approaches college. Although you definitely need equity exposure over the 18-year investment horizon to obtain the returns needed for significant growth, you do not want 100% equity exposure when your child is a senior in high school. Just imagine if you were a parent of a child beginning college in 2009. Would you want the money you spent years setting aside for tuition to be invested in the US stock market of 2008? The answer is simple: no. In order to successfully hedge against variability in returns as your child approaches college, the “glide path” helps decrease global equity exposure, thus decreasing risk and volatility in the portfolio. This concept is demonstrated in the figure below (UESP Age-Based Moderate Global Allocation3).

The UESP allows Avier, as your advisor, to develop a customized globally-diversified allocation along with the appropriate “glide path” from the beginning of your planning process. After doing an in-depth analysis and projection of future college expenses, we can help you successfully determine the required amount of principal you need to contribute to the account on either a monthly or yearly basis. College savings is made easy with recurring contributions, automatically invested into a customized allocation we have strategically developed on your behalf.

Ultimately, the key to any savings strategy is to start early. Many of us are lucky we have 35+ years to save for retirement. However, when it comes to saving for our child’s education, we are usually limited to only 18-20 years of investing. This is why the best thing any family can do is plan ahead. The next best thing a family can do is plan with a purpose. Fortunately, at Avier Wealth Advisors, we help you do both. So once you trade in the coupe for a minivan and your newborn finally falls asleep, take a moment to make a plan for investing in your child’s future.

If you already have an existing 529 or State-sponsored college savings plan, click here to compare how it matches up against all of the college savings plans offered nationwide.

1 US Bureau of Labor Statistics – https://www.bls.gov/news.release/hsgec.nr0.htm

2 College Board organization – https://trends.collegeboard.org/content/average-rates-growth-published-charges-decade-0

3 College Board – https://trends.collegeboard.org/college-pricing/figures-tables/tuition-and-fees-and-room-and-board-over-time-1