2024 Updates for the Amazon Mega Backdoor Roth

In 2024, Amazon employees can contribute thousands to a Roth using the Mega Backdoor Roth provision within the Amazon 401(k).

The Mega Backdoor Roth allows you to contribute up to an additional $39,100 and then convert those dollars to Roth.

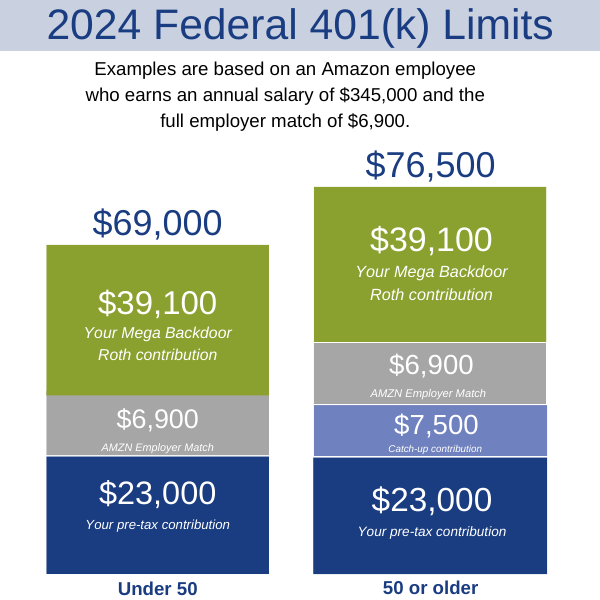

The 2024 federal contribution limits for 401(k) plans are:

- $69,000 if you’re under 50

- $76,500 if you’re 50 or older

If you are already contributing the maximum amount to your Amazon 401(k), this is a fantastic way to save even more for retirement.

2024 Amazon 401(k) Basics

Amazon 401(k)

First, let’s walk through how your Amazon 401(k) works. Your 401(k) contributions increased in 2024:

- If you’re under 50 you can contribute $23,000.

- If you’re 50 or older you can contribute $30,500 ($23,000 plus a $7,500 catch-up contribution). If you turn 50 in 2024, you are eligible for the catch-up contribution.

You can make these contributions on a pre-tax or Roth basis. The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k): “Pay the taxes later”

With a traditional pre-tax 401(k), you make your contributions before taxes. Your contributions do not count as income, reducing your taxable income for that year. However, distributions in the future will be taxed as ordinary income.

Roth 401(k): “Pay the taxes now”

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed.

Amazon Employer Match

Amazon will provide you with a 50% match on the first 4% contributed, meaning they will contribute 2% of your base salary to your 401(k). The maximum amount Amazon can match in 2024 is $6,900. (per IRS 2024 annual compensation limits[1]) To receive the match, you must contribute at least 4%.

For example, if you’re making $345,000 and you put $23,000 into your 401(k), Amazon will contribute $6,900 as a match (2% of your base salary).

Amazon Mega Backdoor Roth Example

To illustrate how you can contribute thousands in after-tax contributions, let’s walk through a couple of examples.

Employee Under 50 Years Old

In our first example, our Amazon employee is under 50, earns a base salary of $345,000, and maxes out their 401(k) contributions:

- 401(k) contribution: $23,000

- Amazon match (2% of salary): $6,900

Employee pre-tax contributions and the Amazon match equal $29,900, but the employee is still able to contribute another $39,100 in after-tax dollars and immediately convert those dollars to Roth within the 401(k).

Employee Who is 50 and Older

For someone who is 50 or older, the federal limit increases. In the second example, our employee earns $345,000 and maxes out their 401(k):

- 401(k) contribution: $23,000

- 401(k) catch-up contribution: $7,500

- Amazon match (2% of salary): $6,900

The federal limit for 401(k) contributions is $76,500 if you’re 50 or older, meaning our example employee can also contribute up to $39,100 in after-tax dollars and immediately convert those dollars to Roth.

Set Your 401(k) and After-Tax Contributions

Amazon will let you contribute a percentage from each paycheck to your 401(k) over the course of the year up to the federal limit. You will need to go into Fidelity NetBenefits to set your contributions.

A quick note about setting your contributions:

- You can only enter a percentage and cannot specify a certain dollar amount.

- To help ensure you make the most of your contribution, round up your percentage to a whole number. For example, if 12.8% is your max contribution based on your salary, round up to 13%.

Contribution Considerations

The dollars you invest into your Mega Backdoor Roth are long-term dollars. If you decide to max out your 401(k) and Mega Backdoor Roth, that is ~$52,000 you are no longer receiving as part of your paycheck.

If you have other large saving goals, such as saving for a down payment on a home or your children’s college tuition, you will need to allocate these short to mid-term dollars into different saving buckets (like a brokerage account).

Choose What’s Best for You

Fortunately, the amount you want to contribute is totally up to you! You can look at your current situation and decide how much to contribute. It can be $1,000, $10,000, or any amount up to the federal limit.

Supplement Your Cash Flow Using Amazon Restricted Stock Units (RSUs)

As an Amazon employee you may receive Restricted Stock Units.

RSUs can be sold once they vest. With thoughtful planning you can sell these shares and use the proceeds for your day-to-day living expenses.

Selling Your Amazon RSUs

There are a couple of reasons to consider using this strategy

- It helps you maintain a diversified portfolio.

- It can free up cash from your salary to allocate towards tax-advantaged accounts like your 401(k), Mega Backdoor Roth, Health Savings Account (HSA)

Tax-Free Growth on After-Tax Roth Contributions

The Mega Backdoor Roth is a way for high-income earners to contribute after-tax dollars to their 401(k) over and above the 2024 contribution limits. These after-tax contributions can be converted to Roth.

Roth Benefits:

- Tax free growth!

- Tax free distributions!

- Added flexibility with tax efficient withdrawal strategies in retirement

Long-Term Benefits of the Amazon Mega Backdoor Roth

Needless to say, the long-term benefits of increasing your retirement savings, particularly by utilizing the Amazon Mega Backdoor Roth Conversion strategy, could make a massive positive impact on what your retirement looks like.

Questions About the Amazon Benefits?

Schedule time with one of our advisors to discuss how to make the most of your Amazon benefits.