PIMCO 10-Year Capital Market Assumptions

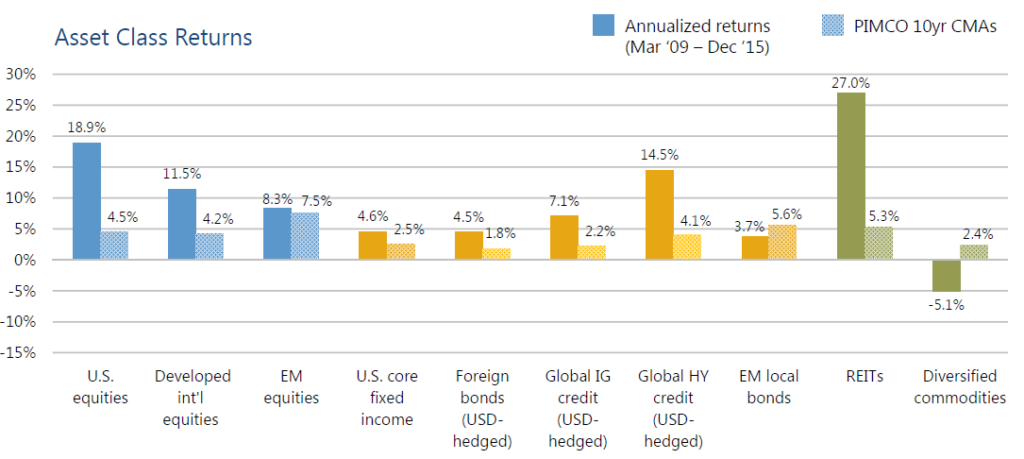

Every year PIMCO convenes a cyclical forum to discuss macroeconomic trends and the implications for investment policy decisions. As part of that forum they produce a 10-year projection of returns for various asset classes we thought would be of interest to a wider audience.

Asset Class Expectations

Overall, PIMCO believes forward looking returns will be much more limited than those seen since the Great Recession (from March 2009 onward). The most notable exceptions to these reduced asset class return expectations are Emerging Markets and Commodities. During the last 6 years, commodities and countries whose economies are based on the export of commodities saw muted and negative returns. A diversified commodity fund saw the largest degree of underperformance consistent with muted inflation. With inflation expectations in the future higher than those experienced in the last 6 years, many commodity prices are at a low starting point compared to their historical averages (notably oil and energy sector goods). Commodities are poised to perform better than the -5.1% annualized observed return from March 2009 to December 2015.

Global Macroeconomic Backdrop

PIMCO expects global growth to continue to grow at a rate of 2.25%-2.75%, with global inflation edging a bit higher to 1.75%-2.25%. PIMCO also stated outright that “investors should adjust their returns expectations lower and volatility expectations higher.” This announcement of projected higher volatility is in line with data showing the last 5 years have not been particularly volatile. Investors, especially US Stock and US Bond investors have been rewarded significantly for investments in those asset classes. PIMCO expects oil prices to go up to around $50/barrel over the next several months, which may lead to higher inflation expectations. Any further declines in oil prices could weigh on global inflation.

PIMCO’s Investment Risks over the Cyclical Horizon

At Avier, we continue to believe we should remain focused on those things that we can control. Remaining diversified and tilting the portfolio towards other investment premiums such as value, small cap stocks, and profitability, give us a greater possibility of outperforming PIMCO’s asset class return projections. Keeping costs low and limiting tax drag allows the end investor to capture as much of each asset class return as possible.

Appendix