Amazon’s 401k & Roth Conversion

Avier Wealth Advisors is not affiliated with Amazon. While Avier communicates with its clients regarding their Amazon employee benefits, and educates itself on the Amazon Benefits, there is no guarantee that the information we have provided is accurate. Amazon employees are encouraged to contact their employer should they have any questions regarding their specific employee benefits.

Amazon’s 401(k): What’s New for 2024?

The Amazon 401(k) is a retirement savings plan that allows employees to invest a portion of their salary into long-term investments and save for their retirement.

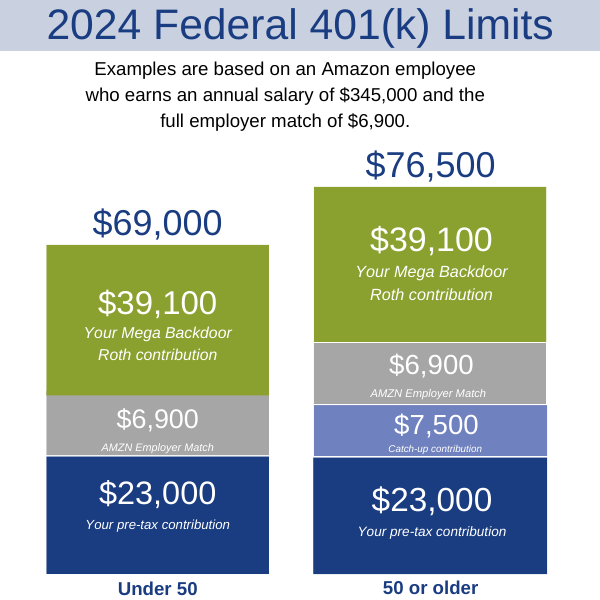

2024 401(k) Contribution Limits:

- Under 50: $23,000

- 50 and older: $30,500 ($23,000 + $7,500 catch-up contribution)

These contributions can be made on a traditional, pre-tax, or Roth basis.

The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k): “Pay the taxes later”

With a traditional pre-tax 401(k), you make your contributions before taxes. Your contributions do not count as income, reducing your taxable income for that year. However, distributions in the future are taxed as ordinary income.

Roth 401(k): “Pay the taxes now”

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed.

Amazon Employer Match

Amazon matches 50% of your first 4% 401(k) contributions, up to $6,900 in 2024. (per IRS 2024 annual compensation limits [1])

This means they’ll contribute 2% of your base salary. To get the full match, contribute at least 4%.

Example: You earn $345,000 and contribute $23,000), Amazon will contribute $6,900 as a match (2% of your base salary).

Bonus: Your contributions go in your account right away, but the match vests after 3 years.

Amazon Mega Backdoor Roth Conversion

The Mega Backdoor Roth is a provision within your 401(k).

It allows you to contribute after-tax dollars to your 401(k), up to the IRS federal limit, and convert those dollars to Roth. We think this is one of best benefits available to Amazon employees.

Mega Backdoor Roth Example

To illustrate how you can contribute thousands in after-tax contributions, let’s walk through an example:

Employee Under 50 Years Old

Our example Amazon employee is under 50, earns a base salary of $345,000, and maxes out their 401(k) contributions:

- 401(k) contribution: $23,000

- Amazon match (2% of salary): $6,900

Employee pre-tax contributions and the Amazon match equal $29,900, but the employee is still able to contribute another $39,100 in after-tax dollars and immediately convert those dollars to Roth within the 401(k).

Convert After-Tax Dollars to Roth

The Amazon Mega Backdoor Roth 401(k) allows you to fill the gap between your regular contributions and the Federal limit using after-tax dollars.

Sustainable Investment Options

Sustainable Investing, also known as Socially Responsible Investing (SRI), means incorporating Environmental, Social, and Governance (ESG) criteria into the investment selection process.

Essentially, this allows you to invest in a way that aligns with your values without necessarily compromising diversification or returns.

While there is currently just one socially focused fund option within your standard Amazon 401(k), you can access hundreds of SRI mutual funds and ETFs through BrokerageLink.

BrokerageLink Option

BrokerageLink is one of 26 options offered within your Amazon 401(k) plan. It allows you to invest in asset classes that would otherwise be unavailable to you in your standard 401(k), including funds managed by Vanguard, PIMCO, and Eaton Vance.

Utilizing the BrokerageLink option within your 401(k) provides you with more investment choices including additional sustainability and ESG focused funds, letting you invest with both your future and the planet in mind.

MORE AMAZON INSIGHTS

For more information and advice from our Amazon-focused advisors visit our main Amazon page, or other pages focused on Amazon Compensation and Miscellaneous Benefits, or Amazon RSUs.

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.