Microsoft 401(k) & Retirement

Microsoft’s 401(k): What’s New for 2024?

The Microsoft 401(k) is a retirement savings plan that allows you to invest a portion of your salary into long-term investments to save towards retirement.

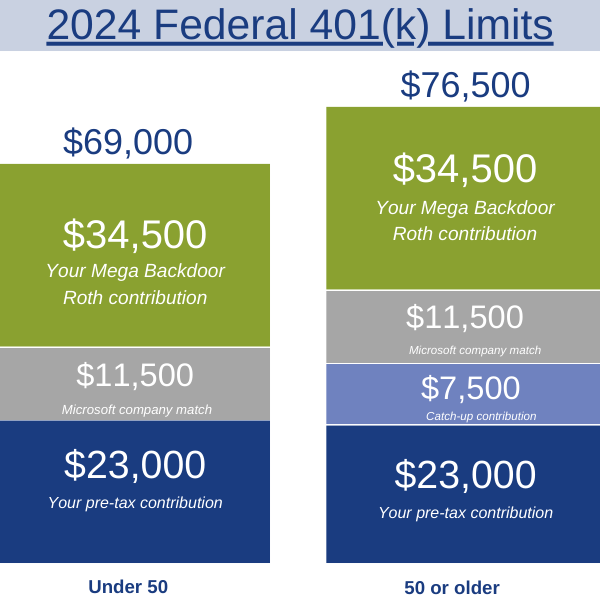

Your 401(k) contributions increased in 2024:

- Under 50: $23,000

- 50 or older: $30,500 ($23,000 + $7,500 catch-up contribution)

These contributions can be made on a traditional pre-tax or Roth basis.

Microsoft Employer Match

Microsoft will match 50% of your 401(k) contributions, up to the federal limit.

In 2024 you can receive a match up to $11,500 from Microsoft, if you contribute the max of $23,000.

If you are 50 or older, the maximum match remains at $11,500, as catch-up contributions are not eligible for the 50% match.

Your contribution and the Microsoft match are 100% vested from day one with the company.

Understand Your 401(k) Options

You can make your 401(k) contributions on a traditional pre-tax or Roth basis. The difference between each comes down to when you pay taxes.

Traditional Pre-Tax 401(k) – Pay Taxes Later for Potential Future Savings

You make your contributions before taxes. Contributions do not count as taxable income, reducing your taxable income for that year. Distributions in the future are taxed as ordinary income.

Roth 401(k) – Pay Taxes Now. Your Withdrawals are Tax-Free in Retirement

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed.

Generally, people find themselves in a lower tax bracket when they retire, making pre-tax contributions to a 401(k) more attractive during working years.

Microsoft Mega Backdoor Roth Conversion

The Mega Backdoor Roth is a provision within your Microsoft 401(k).

It allows you to contribute after-tax dollars to your 401(k), up to the IRS federal limit and convert those dollars to Roth. We think this is one of the best benefits available to Microsoft employees.

In 2024, the IRS federal limits for 401(k) contributions are:

- Under 50: $69,000

- 50 or older: $76,500

Maximize Your Retirement Savings with the Mega Backdoor Roth

Let’s walk through an example of an employee who is under 50 and can fully leverage their Microsoft 401(k).

Maxing out pre-tax contributions

Our example employee contributes the maximum pre-tax amount of $23,000 to their 401(k) in 2024.

Earning the employer match

Microsoft matches 50% of their contribution, adding $11,500 to their 401(k).

Leveraging after-tax contributions

To further boost their savings, our example employee contributes an additional $34,500 in after-tax dollars to their 401(k). This is possible because their total pre-tax contributions and match are still below the 2024 federal limit of $69,000.

Mega Backdoor Roth Benefits

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth. Why?

Increased retirement savings

Allows you to contribute significantly more to your retirement account, potentially reaching the federal limit of $69,000 (or $76,500 if you’re 50 or older).

Tax-free growth

Within a Roth your money grows tax-free. These same dollars, and the growth, are tax-free when accessed in retirement.

Tax diversification

Creates a balance of pre-tax and Roth savings, providing more flexibility on the types of withdrawals you can make in retirement.

MORE MICROSOFT INSIGHTS

For more information and advice from our Microsoft-focused advisors visit our main Microsoft page, or other pages focused on Microsoft Compensation and Miscellaneous Benefits, or Microsoft RSUs and ESPP. If you are a Level 67 or higher employee at Microsoft, visit our Microsoft Deferred Compensation Plan page.

READY to get started?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.