NVIDIA Employee Benefits

Avier Wealth Advisors is not affiliated with NVIDIA. While Avier communicates with its clients regarding their NVIDIA employee benefits, and educates itself on the NVIDIA benefits, there is no guarantee that the information we have provided is accurate. NVIDIA employees are encouraged to contact their employer should they have any questions regarding their specific employee benefits.

How Do I Maximize My NVIDIA Employee Benefits in 2024?

As your career evolves at NVIDIA, your salary increases and stock awards compound. Your benefits can help you realize financial security when leveraged correctly.

We know how busy you are and value your time. We help you optimize your equity compensation, reduce taxes, and plan for your long-term goals.

Navigate Your NVIDIA Benefits and Compensation

NVIDIA employees can be compensated in a few different ways; base salary, bonus, and stock awards. All sources of compensation need to be considered to ensure your plan is tax-efficient while current and future cash-flow needs are met.

BASE SALARY

This is the easiest form of income to incorporate into your financial plan.

It is predictable and established when you begin with NVIDIA.

ANNUAL CASH BONUS

Your bonus is a less predictable source of income and is typically awarded at the discretion of your manager.

STOCK AWARDS

Employees may be granted Restricted Stock Units (RSUs) when hired.

RSUs will vest over time and can make up a significant portion of your total compensation. RSU income is taxable and requires careful planning.

Your NVIDIA Restricted Stock Units (RSUs)

Your NVIDIA RSUs will be granted to you over a specified period of time, commonly known as your vesting schedule.

When you get your RSU grant, you’ll also get the vesting schedule. This schedule spells out how many shares you’ll get and when. After the shares fully vest, you can decide whether to keep them or sell them.

Three Things to Consider When it Comes to Your NVDA RSUs

Taxes: Your RSUs are taxed as ordinary at the time of vest. Your custodian will sell some of the stock to mitigate the taxes you would regularly owe on the new compensation. The federal default minimum is 22%. Typically, there are no significant tax advantages for holding on to your NVDA RSUs. Selling your RSUs as they vest might simplify tax implications.

Cash-flow: Use your NVDA RSU proceeds to fund lifestyle expenses. By living off of vesting shares of stock, you gain cash-flow flexibility and can then take advantage of the many tax-preferred benefits available to you through paycheck deductions, like your 401(k) and Mega Backdoor Roth.

Diversification: Holding on to your NVDA RSUs may inadvertently create risk in your portfolio. A well-diversified portfolio can help align your investment strategy with your lifestyle and long-term plan.

NVIDIA 401(k) Basics

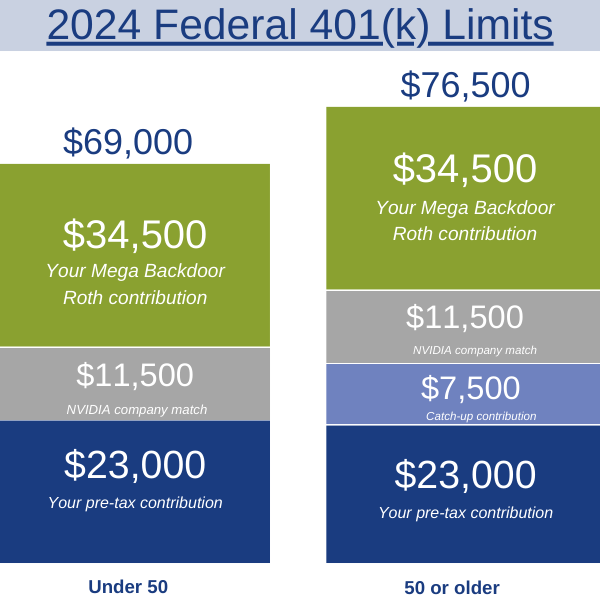

In 2024, you can contribute the following to your 401(k):

- If you’re under 50 you can contribute up to $23,000.

- If you’re 50 or older you can contribute up to $30,500 ($23,000 plus a $7,500 catch-up contribution).

These contributions can be made on a traditional pre-tax or Roth basis.

NVIDIA Employer Match

For 2024, employees who contribute to their NVIDIA 401(k) can earn a match up to $11,500. NVIDIA will match dollar-for-dollar every pay period, up to $6,000. Then they will match fifty cents for each dollar for the next $11,000.[1]

We explain how the NVIDIA 401(k) and employer match work in more detail in our blog.

NVIDIA Mega Backdoor Roth (After-Tax Roth Conversion)

The Mega Backdoor Roth feature allows you to contribute in after-tax dollars and automatically convert those dollars to Roth.

In 2024, the total contribution limit for a 401(k) plan is:

- $69,000 if you’re under 50.

- $76,500 if you’re 50 or older.

This limit applies to all sources of contributions, including employee, employer match, and catch-up contributions.

You can fully leverage these limits by taking advantage of the Mega Backdoor Roth – a powerful benefit within your NVIDIA 401(k).

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth.

OTHER BENEFITS

EMPLOYEE STOCK PURCHASE PLAN (ESPP)

The ability to purchase NVIDIA shares at a discount. You can enroll in ESPP during the month you’re hired or during an official enrollment period, which occurs in February or August. Elect to contribute up to 15% of your salary through payroll deductions.[2]

HEALTH BENEFITS

NVIDIA offers its employees the option to enroll in a Health Savings Account (HSA). The HSA comes with 3 significant tax benefits: contributions are tax-free, money grows tax-deferred, and you can withdraw the money tax-free if the funds are used for qualified medical expenses. And, once you reach age 65, you can use your HSA dollars for any reason without penalty, only paying ordinary income taxes. Essentially, turning your HSA into a pre-tax retirement account, like a traditional IRA or 401(k).

STUDENT LOAN REPAYMENT PROGRAM

If you are a full-time NVIDIA employee and graduated within the past three years, you may be eligible to apply for reimbursement up to $350 a month to help repay your student loans–up to a lifetime maximum of $30,000.

Certain requirements/limits apply. [3]

DISCOUNT INSURANCE PLANS

Eligible NVIDIA employees may apply for a variety of discounted insurance plans. Examples of plans include auto and home, business travel, disability, life, and pet insurance. [4]

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.