Meta Employee Benefits

Avier Wealth Advisors is not affiliated with Meta. While Avier communicates with its clients regarding their Meta employee benefits, and educates itself on the Meta Benefits, there is no guarantee that the information we have provided is accurate. Meta employees are encouraged to contact their employer should they have any questions regarding their specific employee benefits.

How Do I Maximize My Meta Employee Benefits in 2024?

As your career evolves at Meta, your salary increases, and stock awards compound. Your benefits can help you realize financial security when leveraged correctly.

We know how busy you are and value your time. We help you optimize your equity compensation, reduce taxes, and plan for your long-term goals.

Navigate Your Meta Benefits and Compensation

Meta Employee Compensation

Meta employees are compensated in three different ways:

Base Salary

This is very straight-forward, your base salary is paid out bi-weekly.

Cash Bonus

You may receive a sign-on bonus at the time you’re hired. Meta also awards performance bonuses.

Restricted Stock Units (RSUs)

Your Meta RSUs vest over time and typically make up a significant portion of your total compensation. This income is taxable and requires significant planning.

Meta Restricted Stock Units

Your stock awards come in the form of Restricted Stock Units (RSUs).

For many Meta employees, RSUs can be a significant portion of total compensation.

You may receive stock awards upon being hired, as a part of your annual compensation package, or as a special award. Your stock awards become available to you as they vest over time.

Meta’s vesting schedule is split evenly over 4 years. This means you get 25% of your equity each year. Your RSUs vest 4 times a year.

As the stock shares vest, you are taxed at ordinary income tax rates based on the total value of the vesting shares of stock.

Three Things to Consider When it Comes to Your Meta RSUs

Taxes

Your RSUs are taxed as income at the time they vest.

You can elect to withhold anywhere from 22% to 37% for federal taxes on your vesting RSUs.

You can change your withholding amount at any time, but the rate change must be applied one week prior to your quarterly vest date.

Cash-Flow

Use your Meta RSU proceeds to fund lifestyle expenses.

Living off of vesting shares of stock can provide you with cash-flow flexibility.

This strategy may help you take advantage of the many tax-preferred benefits available through paycheck deductions, like your 401(k), HSA, and Mega Backdoor Roth.

Diversification

A well-diversified portfolio can help align your investment strategy with your lifestyle and

long-term plan.

Holding on to your Meta RSUs may inadvertently create risk in your portfolio.

Meta 401(k)

The Meta 401(k) allows employees to invest a portion of their salary into long-term investments and save for their retirement.

2024 401(k) Contribution Limits

- $23,000 if you’re under 50

- $30,500 if you’re 50 or older ($23,000 + $7,500 catch-up contribution)

There are 2 ways employees can contribute to their 401(k):

Traditional Pre-Tax 401(k)

You can make pre-tax contributions. Doing this means you will get a tax break up front, lowering your current income tax bill. Money withdrawn at retirement will be taxed.

Roth 401(k)

Your contributions to a Roth are already taxed. With this option, money withdrawn at retirement will not be taxed.

The difference between a Traditional and a Roth 401(k) comes down to when you pay taxes. Roth accounts are generally advised for younger savers; however, a Roth 401(k) can also provide older savers the chance to benefit from tax-free distributions.

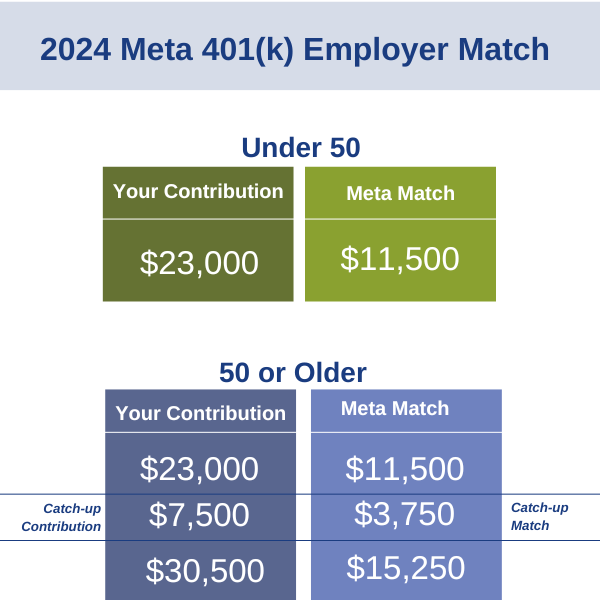

How Much is the Employer Match?

Meta will match your 401(k) contributions dollar for dollar up to 50% of the IRS Federal limit. In 2024, if you are under 50 years old, Meta will match up to $11,500.

Meta Will Match Your Catch-Up Contribution

For someone who is 50 or older, Meta will also match your catch-up contribution dollar for dollar, up to 50% of the IRS Federal limit.

In 2024, this is an additional $3,750 towards your 401(k) on top of the $11,500 for a total match of $15,250.

Meta is one of the only tech companies we have seen to offer this benefit.

Your Meta match is essentially free money from the company. We strongly encourage Meta employees to prioritize their 401(k) and employer match above all other employee benefits.

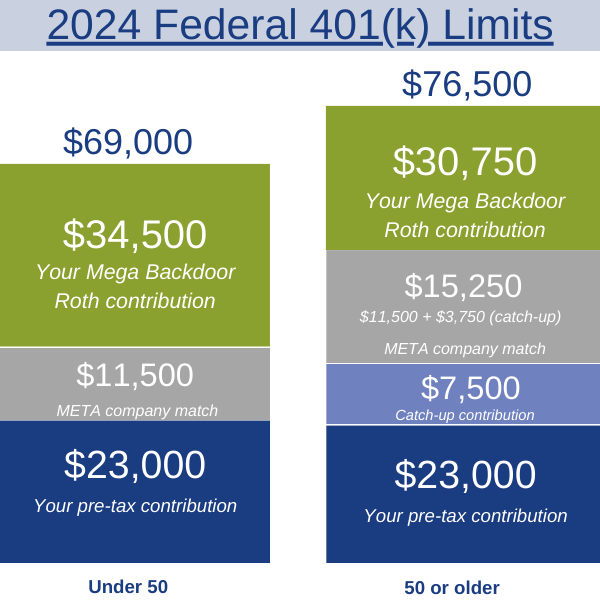

Meta Mega Backdoor Roth

The Mega Backdoor Roth allows you to save even more for your retirement and reduce some of your future tax liabilities.

This provision within your 401(k) enables you to contribute after–tax dollars to your 401(k) up to the federal limit. You can convert these dollars to a Roth.

2024 401(k) IRS Federal Limits

$69,000 if you’re under 50 years old

$76,500 if you’re 50 or older (includes the $7,500 catch-up contribution)

Reach out with Questions on Your Meta Employee Benefits

Schedule a 30-minute call with one of our advisors to ask your specific questions.

Latest Articles About Your Meta Benefits

What is the Meta 401(k) Employer Match?

Tax-Efficient Retirement Savings Your Meta 401(k) is a retirement savings plan that allows you to invest a portion of your salary into long-term investments and save for retirement. Your contribution and the Meta match are 100% vested from day one with the...

What is the Meta Mega Backdoor Roth?

In 2024, Meta employees can contribute thousands to a Roth using the Mega Backdoor Roth provision within the Meta 401(k). The Mega Backdoor Roth allows you to contribute after-tax dollars to your 401(k) and convert those dollars to Roth. The 2024 federal limits...

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.