Work with Avier

Improving the Financial Lives of Tech Professionals

Feel confident about your finances. Take control of your taxes. Decide when work becomes optional.

How Can We Help?

I’m looking to work with an Avier Advisor and want to schedule a 30-minute call:

Schedule a Consultation

To help us point you in the right direction, please let us know who you work for.

We work with many tech professionals in the PNW and have listed a few companies below. If you are retired or don’t see your employer, select the appropriate option.

You’ll be able to schedule time with an advisor on the next screen.

I have complex employer benefits:

- Restricted Stock Units (RSUs)

- Stock Options

- Deferred Compensation Plan (DCP)

- 401(k) / Mega Backdoor Roth

I want to establish a long-term financial plan:

- Tax planning

- Retirement planning

- Compensation planning

- Estate planning

- Charitable giving plan

I’m not ready to work with an advisor but need some expert advice:

I’m early on in my career and have questions on:

- Knowing how to invest my 401(k)

- Establishing a budget and savings goals

- Understanding investment basics

I want advice for paying off debt:

- Student loans

- Credit cards

Building Connections

A process designed for you.

Our team will guide you through each step. If at any time during the process you change your mind, that’s okay. We approach every meeting with the same objective, which is to help you determine what is right for you and your financial future.

1 – Introductory Call

We’re excited to meet you!

On this call, we’ll get to know each other. We’ll answer your questions and outline our process.

Our goal is to collaboratively decide on the next steps – whether that is moving on to the discovery meeting or providing you with resources to find what is best for you.

30-minute virtual call.

2 – Discovery Meeting

Share your story.

Tell us about you, your family, and your values. We want to hear what you envision for your future. Your responses will guide our detailed analysis of recommendations in our upcoming meeting.

The outcome for the meeting is to learn about what matters most to you and to explain expectations for the planning meeting.

60-minute virtual or in-person meeting.

3 – Planning Meeting

Your next steps.

Using what we have learned in the discovery meeting, we will present a customized plan that aligns your money with your life and values. We’ll discuss strategies to help you make progress towards your long-term objectives.

After this meeting we want you to walk away with a solid understanding of what it would be like to work with Avier.

60-minute virtual or in-person meeting.

4 – Implementation Meeting

Welcome to Avier!

Once you sign the Investment Management Agreement, we will fine tune and implement the financial planning strategy discussed with you. We keep the paperwork simple and streamlined during the account opening process.

At the end of this meeting, we want to ensure you are fully integrated with your Avier team.

Meet Your Lead Advisor

Aaren Strand,

CFP®

Alex Krider,

CFP®, EA, MBA

Angela Sorensen,

CFP®, ECA, MBA

Lars Phillips,

CFA, CFP®

Nick Wright,

CFA, CFP®

Saloni Gupta,

CFP®

An Integrated Plan Focused on You

Your success matters to us.

We tailor every aspect of our services towards your long-term financial well-being.

FINANCIAL PLANNING

Define goals to support your success.

BENEFITS & COMPENSATION

Determine what is best for you and why.

TAX

STRATEGIES

We proactively work to reduce your tax bill.

INVESTMENT PLANNING

Protect and preserve your wealth.

INSURANCE PLANNING

Safeguard your family and assets.

ESTATE PLANNING

Share assets with your loved ones and causes.

Meet More of the Avier Team

Focused on building long-lasting relationships.

Ongoing full-service financial planning tailored to you with regular and consistent communication.

Explore the Different Ways We Can Work with You

I’m looking to work with an Avier Advisor and want to schedule a 30-minute call:

I have complex employer benefits:

- Restricted Stock Units (RSUs)

- Stock Options

- Deferred Compensation Plan (DCP)

- 401(k) / Mega Backdoor Roth

I want to establish a long-term financial plan:

- Tax planning

- Retirement planning

- Compensation planning

- Estate planning

- Charitable giving plan

I’m not ready to work with an advisor but need some expert advice:

I’m early on in my career and have questions on:

- Knowing how to invest my 401(k)

- Establishing a budget and savings goals

- Understanding investment basics

I want advice for paying off debt:

- Student loans

- Credit cards

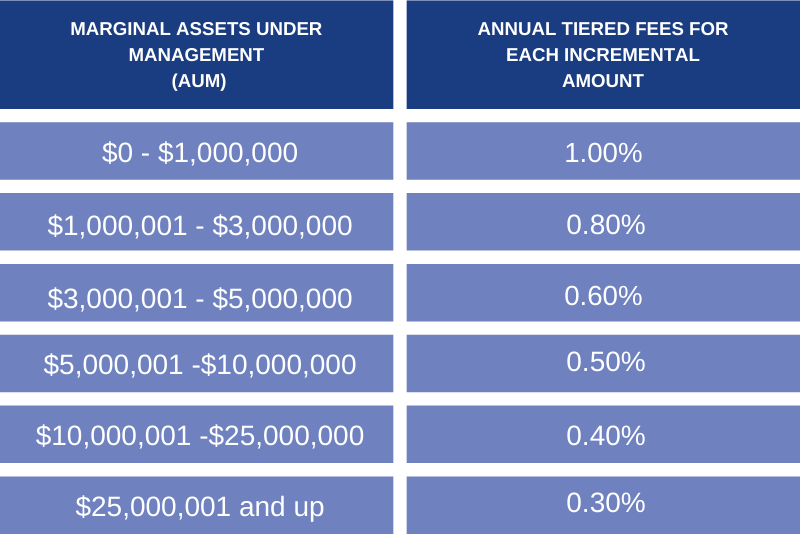

You are Our Top Priority

As fee-only advisors, we only receive compensation from you.

Your interests will always come first.

We do not sell financial products and don’t earn commissions.

We have minimized conflicts of interest so that we can focus solely on what is best for you and your family.

What You Can Expect From Us

What happens after you book a call with an Avier Advisor.

We’re excited to meet you! We want to ensure we’re the best fit for one another, so we can establish a lasting partnership to provide the best advice for you and your family.

Our goal throughout every step is to help define what is right for you.

1 – Introductory Call

On this 30-minute call the priority is to:

- Get to know one another.

- Answer your questions and outline our process.

- Decide together on the best next steps – moving forward or providing you with helpful resources.

2 – Discovery Call

During this 60-minute meeting we will:

- Hear you share your story and vision for the future.

- Learn what matters most to you.

- Explain the next steps.

3 – Planning Meeting

Our goal for this 60-minute meeting is to:

- Help you realize what working together looks like.

- Present a customized plan with analysis and recommendations.

- Discuss strategies to help achieve your objectives.

4- Implementation Meeting

At this 60-minute meeting we will:

- Fully integrate you with your Avier team.

- Take care of the paperwork.

- Begin implementing your financial plan.

Being an Avier Client

Now we enter our ongoing partnership together. As a full-service financial planning firm, we only partner with those clients who are a great fit and for whom we know we can do our best work.

What does this mean for you? You get our best service, tailored to you and your needs. We’re proactively reviewing your portfolio, financial plan, employer benefits, tax updates, etc. so that you don’t have to!

Together, we’ll determine a communication frequency and partner with other professionals such as estate attorneys and CPAs.

Let’s Stay Connected

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.