How does the Microsoft 401(k) and Mega Backdoor Roth Work?

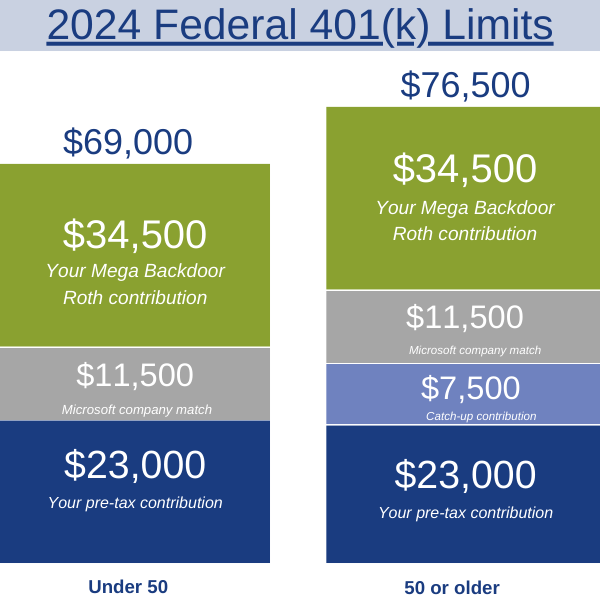

In 2024, the total dollars allowable into a 401(k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.

You can fully leverage these limits by taking advantage of the Mega Backdoor Roth – a powerful benefit within your Microsoft 401(k).

You can use the following features within your 401(k) to reach the federal limit:

- Pre-tax or Roth contributions

- Microsoft employer match

- After-tax contributions

We explain each feature below and in this video:

2024 Microsoft 401(k) Basics

Your 401(k) contributions increased in 2024.

If you’re under 50, you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500 ($23,000 plus a $7,500 catch-up contribution).

These contributions can be made on a traditional pre-tax or Roth basis. The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k)

You make your contributions before taxes. Contributions do not count as income, reducing your taxable income for that year. Distributions in the future are taxed as ordinary income. “Pay the taxes later”

Roth 401(k)

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed. “Pay the taxes now”

Microsoft Mega Backdoor Roth Example

To illustrate how much in after-tax contributions you can make, we’ll walk through two examples.

In our first example, our Microsoft employee is under 50 and maxes out their 401(k). This entitles them to receive the full Microsoft match:

- 401(k) contribution: $23,000

- Microsoft match: $11,500

The pre-tax contribution and Microsoft match equal $34,500. Our example employee has not reached the federal limit of $69,000. This means they can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

For someone who is 50 or older, the federal limit increases. In the second example below, our employee makes the following contributions and earns the full Microsoft match:

- 401(k) contribution: $30,500

- 401(k) catch-up contribution: $7,500

- Microsoft match: $11,500

If you are 50 or older, the federal limit for 401(k) contributions is $76,500. This means our example employee can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

Set Your 401(k) and After-Tax Contributions

Microsoft will let you contribute a percentage from each paycheck to your 401(k) over the course of the year up to the federal limit. You will need to go into Fidelity NetBenefits to set your contributions.

A quick note about setting your contributions:

- You can only enter a percentage; you cannot specify a certain dollar amount.

- To help ensure you make the most of your contribution be sure to round up your percentage to a whole number. For example, if 12.8% is your max contribution based on your salary, round up to 13%.

Supplement Cash Flow Using Microsoft Restricted Stock Units

As a Microsoft employee you may receive Restricted Stock Units which can be sold once they vest.

With careful financial planning you can sell these shares and use the proceeds for your monthly living expenses. This can free up cash from your salary to allocate towards your 401(k) and Mega Backdoor Roth.

How Does the Microsoft Mega Backdoor Roth Help Reduce Taxes?

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth.

Within a Roth your money grows tax-free. These same dollars, and the growth, are tax-free when accessed in retirement.

Having a bucket of retirement assets that can be distributed taxfree provides for greater control of the income you realize and your resulting tax bill throughout retirement.

Questions About Your Microsoft Employee Benefits?

If you have questions about how much to contribute or how to utilize the Microsoft Mega Backdoor Roth, please schedule time with an Advisor.