Tax-Efficient Retirement Savings

Your Meta 401(k) is a retirement savings plan that allows you to invest a portion of your salary into long-term investments and save for retirement.

Your contribution and the Meta match are 100% vested from day one with the company.

2024 Meta 401(k) Basics

Your 401(k) contributions increased in 2024.

If you’re under 50 you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500.

Pre-Tax and Roth Contributions

These contributions can be made on a traditional pre-tax or Roth basis. The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k):

You will typically receive a tax break up front when you make pre-tax contributions.

- You lower your taxable income when you make contributions pre-tax.

- When you withdraw the funds in retirement, you will be taxed.

Roth 401(k):

You pay taxes on your income now and typically receive a tax break in retirement.

- With a Roth 401(k) you pay taxes first and then make your contributions.

- When you withdraw the funds for retirement, you are not taxed.

For many high-income earners, we recommend contributing pre-tax dollars to your 401(k). This is one of the most effective ways to reduce your taxable income.

The Meta Employer Match. Earn Free Money.

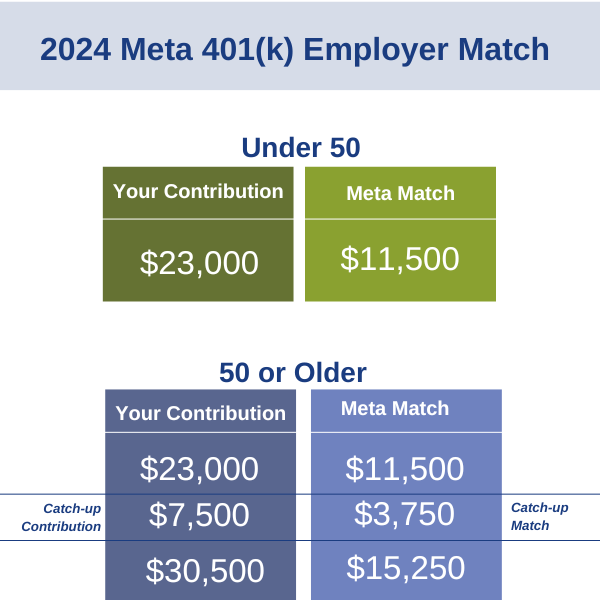

Meta will match $1 for $1 of your 401(k) contribution up to 50% of the IRS Federal elective deferral limit.

Your employer match from Meta is essentially free money.

We encourage you to make the most of this benefit by maxing out your 401(k) contributions before utilizing any other benefits available to you.

Under 50 Years Old

If you are under 50 years old, you can contribute up to $23,000. This means you can earn up to $11,500 from the Meta match.

50 Years Old or Older

Now this part is huge! If you are over 50, you can make a catch up contribution of $7,500 on top of the $23,000, this equals $30,500.

Meta will also match $1 for $1 of your catch-up contribution up to 50% of the catch-up contribution limit. This is an additional $3,750 on top of the $11,500 for a total match of $15,250.

Supplement Cash Flow Using Meta Restricted Stock Units (RSUs)

Meta employees receive Restricted Stock Units (RSUs) as part of their compensation.

Manage Cash Flow

With careful financial planning you can sell these shares and use the proceeds for your day-to-day living expenses. This can free up cash from your salary to allocate towards your 401(k) and other tax-advantaged Meta benefits like the Mega Backdoor Roth and your HSA.

Portfolio Diversification

Selling your RSUs when they vest can help you maintain some diversification within your portfolio. If you allow your Meta RSUs to accrue within your investment account, it can inadvertently create risk in your portfolio.

How Can Saving into a 401(k) Reduce Taxes?

The tax benefits associated with a 401(k) plan include being able to make deductions from your salary on a pre-tax basis. This can lower your annual taxable income.

Your 401(k) earnings accrue on a tax-deferred basis, meaning the dividends and capital gains accumulating within your plan are not subject to tax until they are withdrawn at retirement. Many people are in a lower tax bracket when they retire which compounds the tax reduction benefit of saving into a 401(k).

Questions About Your Meta Employee Benefits?

If you have questions about how much to contribute or how to utilize Meta employee benefits, schedule time to discuss what might make sense for you.