In 2024, Meta employees can contribute thousands to a Roth using the Mega Backdoor Roth provision within the Meta 401(k).

The Mega Backdoor Roth allows you to contribute after-tax dollars to your 401(k) and convert those dollars to Roth.

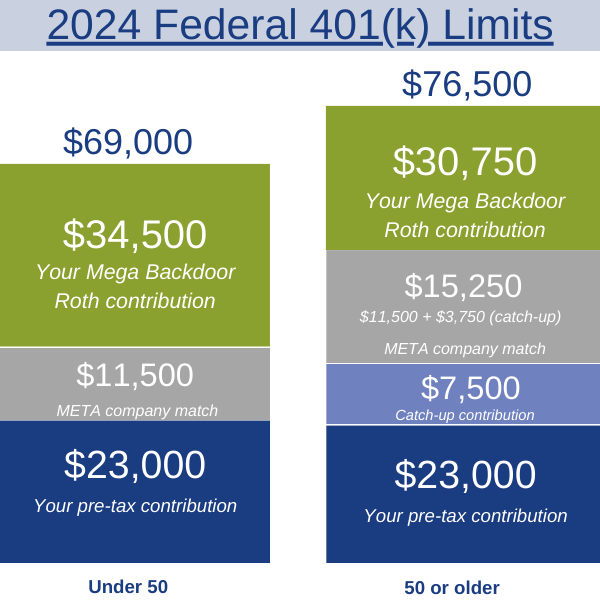

The 2024 federal limits for 401(k) contributions are:

- $69,000 if you’re under 50

- $76,500 if you’re 50 or older

You can fully leverage these limits by taking advantage of the Mega Backdoor Roth – a powerful benefit within your Meta 401(k). If you are already contributing the maximum amount to your Meta 401(k), this is a fantastic way to save even more for retirement.

Meta 401(k) Basics and the Meta Employer Match

In 2024, you can contribute $23,000 into the 401(k) on either a pre-tax or Roth basis if you’re under 50. If you are 50 or older, you can contribute up to $30,500 ($23,000 plus a $7,500 catch-up contribution). If you turn 50 in 2024, you are eligible for the catch-up contribution.

The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k):

You make your contributions before taxes. You typically receive a tax break up front by lowering your current income tax bill; however, money withdrawn at retirement will be taxed.

We often recommend this strategy to high-income earners as it is one of the only ways you can reduce your taxable income.

Roth 401(k):

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed.

We often recommend this strategy to younger savers who are in a lower tax bracket; however, a Roth 401(k) can also provide older savers the chance to benefit from tax-free distributions.

Meta Employer Match

On top of your contribution, Meta will match $1 for $1 of your 401(k) contribution. This match is up to 50% of the IRS federal limit of your compensation deferrals:

- If you are under 50 years old, you can earn up to $11,500.

- If you are over 50, Meta will match $1 for $1 of your catch-up contribution up to 50% of the IRS federal limit. This is an additional $3,750 on top of the $11,250 for a total match of $15,250.

After-Tax Contributions Using the Meta Mega Backdoor Roth

Meta allows employees to contribute after-tax dollars, up to the federal limit. As mentioned above, the IRS federal limit for total contributions to a 401(k), for someone under 50, is $69,000. If you are 50 or older the IRS limit increases to $76,500. This means you could potentially have thousands in after-tax dollars to contribute to your 401(k) and convert those dollars to a Roth.

To illustrate how much in after-tax contributions you can make, we’ll walk through two examples.

In our first example, our Meta employee is under 50 and maxes out their 401(k). This entitles them to receive the full Meta match:

- 401(k) contribution: $23,000

- Meta match: $11,500

The pre-tax contribution and Meta match equal $34,500. Our example employee has not reached the federal limit of $69,000. This means they can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

For someone who is 50 or older, the math is a little different. In the second example below, our employee makes the following contributions and earns the full Meta match:

- 401(k) contribution: $23,000

- 401(k) catch-up contribution: $7,500

- Meta match: $11,500

- Meta catch-up match: $3,750

The federal limit increases to $76,500 for someone who is 50 or older. This means our example employee can contribute up to $30,750 in after-tax dollars and immediately convert those dollars to Roth.

2024 Contribution Limits for Meta Mega Backdoor Roth

Your contribution elections need to be made within Fidelity Net Benefits.

It is very important that after you make your decision on the amount of after-tax dollars you will contribute, you select ‘Convert after-tax to Roth’. That way any growth within the account will essentially never be taxed.

Reduce Future Taxable Income

The Mega Backdoor Roth is a way for high-income earners way to utilize the benefits of a Roth. Within a Roth your money grows tax-free. These same dollars, and the growth, can be tax-free when accessed in retirement.

Having additional money in a Roth account enables you to manage your retirement distributions. This gives you more control over future taxable income.

Questions?

Schedule time with one of our advisors to discuss the Mega Backdoor Roth or any of the other many benefits at Meta.