I believe that nearly everyone has certain causes they feel passionate about. Given the opportunity and resources, I would argue that many of us would love to help create a meaningful impact on issues, such as disaster relief, environmental restoration, or medical improvement. Fortunately, this may be possible with the not often discussed charitable giving tool, the donor advised fund.

What is a Donor Advised Fund?

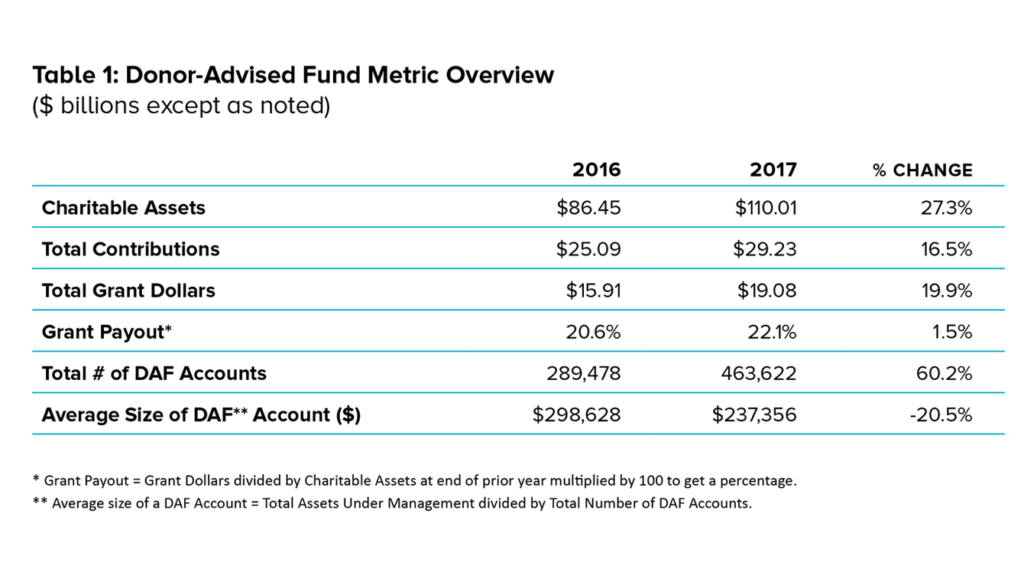

A donor advised fund (DAF) is a tax efficient vehicle used for distributing charitable grants on behalf of another entity. As one can see from the figures below, donor advised funds have become increasingly popular as of late. Philanthropic individuals have become specifically attracted to the flexibility with the type of assets that can be donated and the simplicity associated with setting up these accounts. However, many investors have been looking towards these funds for their charitable gifting needs primarily for the tax advantages enjoyed by the donor.

What are the advantages of a donor advised fund?

1) Immediate Tax Deduction

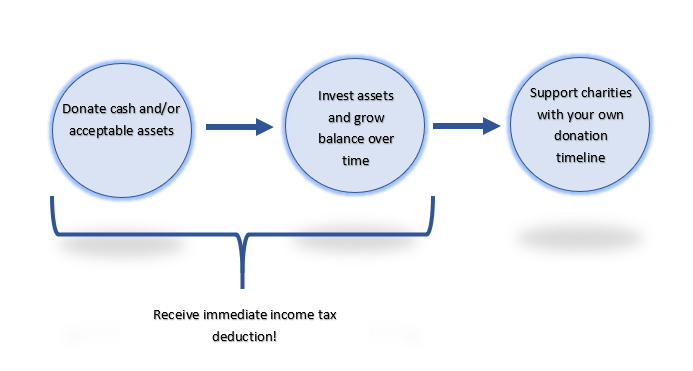

A major benefit of investing in a donor-advised fund is receiving an immediate income tax deduction for the year in which the donor contributes to the account. Even if grants are not donated to the charities of choice for years after initial funding, donors can still realize their income tax deduction in the year of their contribution. This is because donor-advised funds are setup and managed through a public charity, therefore the funding of donor-advised funds act as charitable donations, regardless of when the final contribution to the end charity occurs.

The deduction that a donor receives will vary depending on the asset that is being donated. Currently, the IRS allows donors a maximum deduction of 30% of their adjusted gross income (AGI) for cash contributions and 60% of their adjusted gross income for appreciated assets. If a donor was to contribute assets over the deductible limit, they can carry those deductions forward over a 5-year time period.

2) Tax-Free Growth

Donor-advised funds also allow your assets to be invested prior to being donated to the charity of your choice. This means that while the donor’s assets are held within the account, they can still generate returns. If assets accumulate, the donor will be not responsible for any tax consequences on the growth and the eventual donation to charity will be even larger than originally anticipated.

This becomes especially beneficial for individuals that are unsure which charities they want to issue donations. Instead of delaying the donation (and tax deduction), donors can contribute to a DAF to realize their tax benefit today, while simultaneously allowing their donation to grow until they determine which charities they want to support.

3) Capital Gains and Estate Tax

As mentioned above, donor advised funds are extremely flexible in the assets they accept. A common way donors fund DAFs is through appreciated assets, such as concentrated stock positions and mutual funds. The benefit of donating appreciated securities instead of cash is that donors can eliminate the underlying gain of these positions upon gifting. In addition, once assets have been transferred into the donor advised fund, the donor can freely diversify the position with zero tax consequences. In this case, the donor realizes two tax benefits; tax savings in the form of an income deduction and the avoidance of capital gains.

Although the most rewarding aspect of charity is undoubtably creating a meaningful impact on causes that one cares about, it should be remembered that effectively using donor advised funds can help the philanthropically inclined reap significant personal benefits as well. If you are interested in learning more about donor advised funds, please feel free to reach out.

https://www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds

https://www.aefonline.org/tax-benefits