Are you a Microsoft Level 67 or higher employee who wants to reduce taxes?

The Deferred Compensation Plan benefit is an excellent way to reduce your tax bill by tens of thousands of dollars.

In this video we provide an overview of the benefit. We feel this section on how to reduce your tax bill is by far the most important part of this video and worth explaining in greater detail.

How Does the Microsoft Deferred Comp Plan Work?

Microsoft DCP Example

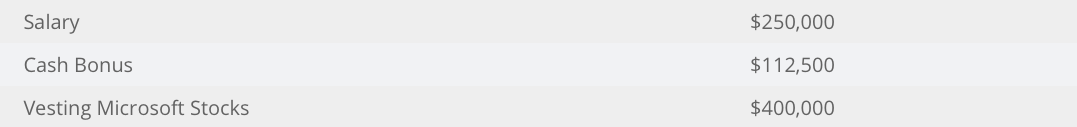

As you know, Microsoft employees are compensated 3 different ways; you receive a salary, cash bonuses, and stock grants.

When we look at your overall compensation, there are a couple of things you can control and a few things you cannot when it comes to reducing your tax bill. The Deferred Compensation Plan allows you to control how much income you realize from your salary and bonus. This deferred income is invested in mutual funds and available for access at a later date when you are in a lower tax bracket.

In addition to salary and bonus, our employee will receive $400,000 in stock vests over the course of a year, which means they will receive $400,000 of additional income on top of salary and bonus.

There is no way to reduce taxable income at this point until they decide to enroll in the Microsoft Deferred Compensation Plan (DCP). This will enable our example employee to defer up to 75% of their salary and up to 100% of their next year’s bonus.

Reduce Your Tax Bill by Tens of Thousands of Dollars

Our employee decides to contribute a total of $150,000 into the Deferred Compensation Plan. They split this amount between bonus and salary.

This action allows them to lower their taxable income by $150,000, when combined with their Microsoft 401k contribution – their overall tax bill is reduced by about $50,000!

Imagine doing this for several years! The amount of taxes you end up reducing can add up to hundreds of thousands of dollars! Not to mention the tax savings on the payouts during retirement, when you are in a lower tax bracket.

Make the Most of Your Deferred Compensation Plan Benefit

We know that Microsoft employees have enough going on, and that finding the time to research, plan and make the appropriate elections into the Deferred Compensation Plan may feel overwhelming.

For many Level 67+ employees, this means they put off enrolling in the DCP. This can amount to tens, if not hundreds of thousands of dollars in taxes beyond what you would pay by utilizing the Deferred Compensation Planning.

If you have questions about how to take full advantage of your compensation package and the benefits of being a Microsoft Level 67+ employee – our team will partner with you to develop a plan, implement, and manage the process.