2024 NVIDIA 401(k) and Mega Backdoor Roth

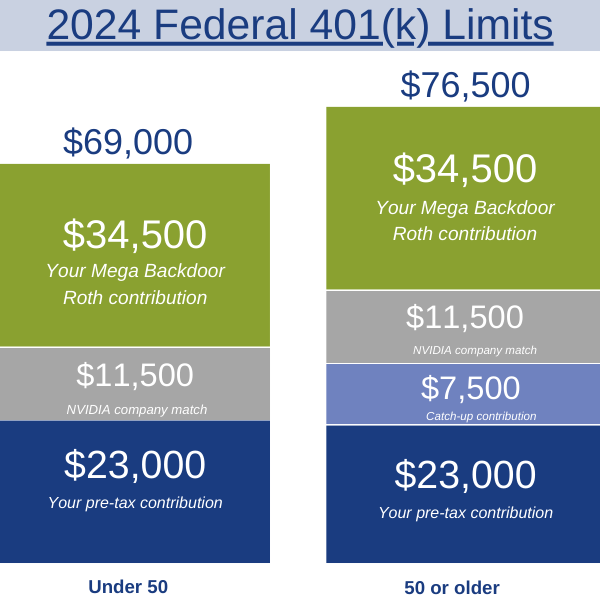

In 2024, you can contribute up to $69,000 if you’re under 50 and $76,500 if you’re 50 or older to your NVIDIA 401(k).

You can fully leverage these limits by taking advantage of the Mega Backdoor Roth. This feature lets you contribute after-tax dollars and convert those dollars to Roth.

To reach these federal limits, your 401(k) offers the following features:

- Pre-tax or Roth contributions.

- NVIDIA’s employer match.

- After-tax contributions using the Mega Backdoor Roth provision.

We will explain each in more detail below and in this video:

2024 NVIDIA 401(k) Basics

Your 401(k) contributions increased in 2024. If you’re under 50 you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500 ($23,000 plus a $7,500 catch-up contribution). These contributions can be made on a traditional pre-tax or Roth basis.

The difference between a traditional and Roth 401(k) comes down to when you pay taxes.

Traditional Pre-Tax 401(k) – Pay Taxes Later for Potential Future Savings

You make your contributions before taxes. Contributions do not count as income, reducing your taxable income for that year. Distributions in the future are taxed as ordinary income.

Roth 401(k) – Pay Taxes Now. Your Withdrawals are Tax-Free in Retirement

With a Roth 401(k) you make your contributions after taxes. When you withdraw savings for retirement, you are not taxed.

Generally, people find themselves in a lower tax bracket when they retire, making pre-tax contributions to a 401(k) more attractive during working years.

NVIDIA Employer Match

NVIDIA offers a match for a percentage of your 401(k) contributions. This is essentially free money that you earn from NVIDIA simply for contributing to your 401(k).

For 2024, employees who contribute to their NVIDIA 401(k) can earn a match up to $11,500. NVIDIA will match dollar-for-dollar every pay period, up to $6,000. Then they will match fifty cents for each dollar for the next $11,000. [1]

NVIDIA Mega Backdoor Roth Example

Under 50 Years Old

To illustrate how much in after-tax contributions you can make, we’ll walk through two examples.

In our first example, our NVIDIA employee is under 50 and maxes out their 401(k). This entitles them to receive the full NVIDIA match:

- 401(k) contribution: $23,000

- NVIDIA employer match: $11,500

NVIDIA employees are able to contribute up to the federal limit. In 2024, for someone under 50, the limit is $69,000.

The pre-tax contribution and NVIDIA match equal $34,500. Our example employee has not reached the federal limit of $69,000.

This means they can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

50 Years Old or Older

For someone who is 50 or older, the federal limit increases. In the second example below, our employee makes the following contributions and earns the full NVIDIA match:

- 401(k) contribution: $23,000

- 401(k) catch-up contribution: $7,500

- NVIDIA employer match: $11.500

If you are 50 or older, the federal limit for 401(k) contributions is $76,500. This means our example employee can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

To convert these dollars to Roth, you will need to call Fidelity when you make your first contribution. Future contributions will automatically convert to Roth after your initial call.

Mega Backdoor Roth Tax Benefits

The Mega Backdoor Roth does not have the same income and contribution limits of a Roth IRA. This means it can provide high-income earners with access to benefits associated with a Roth IRA.

Within a Roth your money grows tax-free. These same dollars, and the growth, can be tax-free when accessed in retirement. Having additional money in a Roth account enables you to manage your retirement distributions. This gives you more control over future taxable retirement income.

Supplement Cash Flow Using NVDA Restricted Stock Units

Determining how much you are able to contribute to the Mega Backdoor Roth can be tricky. You need to think through your monthly cash-flow needs to come up with an amount that works best for your situation.

As an NVIDIA employee you receive Restricted Stock Units (RSUs) which can be sold once they vest. With careful financial planning you can sell these shares and use the proceeds for your monthly living expenses. This can free up cash from your salary to allocate towards your 401(k) and Mega Backdoor Roth.