As the US Presidential Election approaches, many people are wondering what the economic impact of the election results will be. One of their biggest concerns may be how they will be taxed as a result of the election. However, the election result does not inherently guarantee that either candidate’s tax proposal will be passed, or when it will be passed. In this article, we will review some of the possible tax outcomes of a Biden presidency.

While the president can propose tax bills, the House and the Senate must pass the bill in order to turn it into law. Meaning, there are typically adjustments and agreements that change any tax bill originally proposed by a candidate during their election campaign. To add a further complication, while Biden has discussed a number of different tax proposals, there’s still not one single formal plan. Let’s review a couple of key points that most of his proposals have in common:

- Repealing the Tax Cuts and Jobs Act (TCJA) individual income tax reductions for those earning over $400,000 and restoring the top marginal income tax rate to 39.6 percent from the current 37 percent.

- Taxing capital gains at ordinary income tax rates for those earning over $1 million.

- Raising the corporate income tax from 21 percent to 28 percent.

Individual Income Taxes:

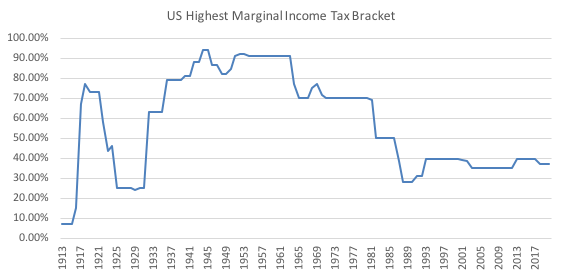

Repealing the Tax Cuts and Jobs Act (TCJA) generally reverses the highest marginal tax bracket back to 39.6% from where it currently resides at 37%. This doesn’t have a huge impact overall, but would definitely bump up income tax for high earners.

A contemporary of Voltaire once said, “life is hard”, to which Voltaire replied, “compared to what?” In the same way, we should look at the tax burden imposed on individuals by comparing the proposed rate on the highest income tax to the recent past and 50 years ago. The highest income tax bracket has remained fairly range bound over the last 30 years, moving between 40% and 35% but nothing like the 1930 to 1980-time frame.

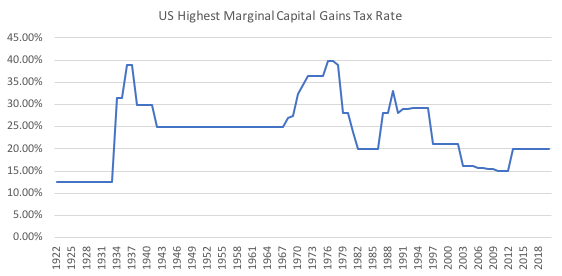

If compared to the recent past, it looks pretty much in line, but compared to 50 years ago, it looks low. However, the capital gains tax rate looks the opposite.

Individual Capital Gains Taxes:

Another one of Biden’s proposed tax changes would be to increase the capital gains tax; specifically, for those who earn over $1M. The proposal entails that the capital gains rate for those making more than $1M/year should be equivalent to the highest income bracket, or 39.6%. For households making over $1M, this would essentially double the current marginal capital gains tax (excluding the additional 3.8% Medicare tax that exists for tax filers who are in the 32% income bracket or higher), 20% vs 39.6%.

While most people don’t expect this to apply to them (and they’re probably right), there are scenarios that can bring you closer to that group than you’d think. Let’s say you’re a tech company employee who was granted a number of shares several years ago. Those shares start vesting, and because US tech stocks have gone up so much, the amount that vests is a much higher number than the amount awarded. When you combine the vesting shares with regular salary, bonus, and potentially the recognition of a large block of capital gains from the sale of your company stock, those combined earnings may push you over the $1M mark. Additionally, consider the capital gains generated by the sale of a home; those can potentially be added to the mix to increase earnings over the $1M mark.

Corporate Taxes:

A third proposal floated by Biden looks to move the corporate taxation rate from 21% to 28%. This proposal comes in conjunction with another: corporations that have $100 million or greater in income would be subject to a 15% minimum tax rate. This proposal would particularly impact Amazon which given its policy of reinvestment, depreciation, and other tax jukes, has managed to minimize taxes on the corporate level. Why should individuals care about this? Corporate taxes fundamentally mean less value for the end investor. Higher corporate taxes mean less earnings, dividends and ultimately company value and therefore, share price. Examined side by side with historical averages, US companies are already expensive compared to their adjusted earnings. Adding on higher taxes increases the headwind for US equity investors. US based investors should take a hard look at their portfolios in order to minimize their exposure to these potential taxes and revisit how their portfolio might be diversified in order to better combat the possibility of higher taxes in the future and reduce their lifetime tax bill.