What is a Stock Split?

A stock split is a decision by a company’s board of directors to increase the number of its outstanding shares by issuing more shares to current shareholders.

Typically, a company decides to do a stock split because its stock price has risen significantly, making it difficult for the average investor to afford. A stock split can attract a broader base of investors.

How Do Stock Splits Work?

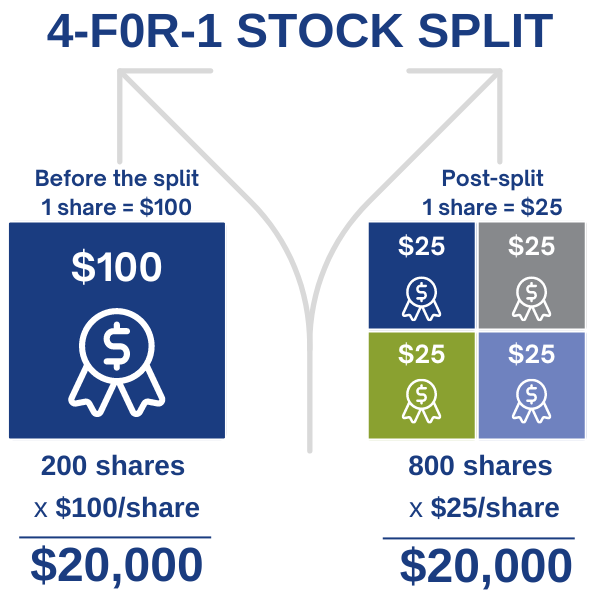

In this example, we will show what it looks like if a company decides to implement a 4-for-1 stock split.

When the split occurs your single share now becomes 4 shares, but the market price is now 25% of the original price, keeping the total value the same.

This means that if you own 200 shares of this company’s stock, and each share is valued at $100, at post-split, you will own 800 shares, but the price of each share would drop to $25.

The total value of your shares stays the same after the split:

- Before the split: 200 shares x $100/share = $20,000

- Post-split: 800 shares x $25/share = $20,000

Understanding Stock Splits: The Pizza Analogy

Imagine you have a whole pizza. This pizza represents a company’s stock, and each slice represents a share of that stock. When a company performs a stock split, it’s like cutting the pizza into more, smaller pieces. The number of pizza slices increases; however, the total amount of pizza stays the same.

Pre-Spilt: Suppose your pizza is initially cut into 8 slices – each slice represents a share of the company. If you own all 8 slices, you own 100% of the pizza.

Executing a stock split: The company decides to do a 2-for-1 stock split. This would be like cutting each of the existing slices in half. You now have 16 smaller slices of pizza.

Post split impact: You have more pizza slices, but the overall size of your pizza hasn’t changed; you still have one whole pizza. Similarly, in a stock split, the total value of your shares stays the same immediately after the split. What changes is the number of shares (slices) you hold and the price per share (size of each slice).

Now that you have 16 slices of pizza, rather than 8, it is easier to share your pizza with more people. The same is true for companies who perform a stock split. The company now has more shares to offer potential investors.

Why Do Companies Perform Stock Splits?

The primary reasons for a stock split include making the stock more accessible to investors by lowering the price per share, increasing liquidity, and widening the shareholder base.

There can be psychological advantages as well, lower-priced stocks are often perceived as more affordable.

Increased Affordability:

When a company’s stock price increases significantly, it can be a barrier for smaller investors. For example, if a stock trades at $1,000 per share, an investor with $500 to invest couldn’t buy even one full share.

After a 10-for-1 split, that same stock would trade at $100 per share, allowing the investor to buy 5 shares. This makes the stock more accessible to a broader range of investors, potentially increasing the investor base.

Improved Liquidity:

When a company decides to split its stock, the price of each individual share usually goes down, making the shares more affordable. This affordability often leads to more people buying and selling the stock, which increases the stock’s trading volume.

For investors, greater liquidity means that there are more buyers and sellers at any given time. This scenario typically results in smaller bid-ask spreads—the difference between the highest price a buyer is willing to pay for a stock and the lowest price a seller is willing to accept.

When a stock can be easily bought and sold, it tends to have a more stable price. This stability can make the company’s stock more attractive to investors.

Psychological Effect:

While a stock split doesn’t change a company’s fundamental value, it can have a positive psychological impact on investors. A stock priced at $50 might seem more attainable or have more “room to grow” than one priced at $500, even if they represent the same ownership stake in the company.

This perception can lead to increased demand for the stock. Additionally, some investors might feel they’re getting “more” for their money when they can buy more shares, even though their overall stake in the company remains the same. This psychological effect can sometimes lead to a short-term boost in stock price following a split announcement or execution.

Recent Notable Stock Splits Within Tech:

Some well-known companies in the tech industry have performed or announced stock splits recently:

- NVIDIA (NVDA) did a10-1 stock split. The split became effective on June 10, 2024.

- Broadcom (AVGO) announced a 10-for-1 stock split effective July 15, 2024.

- LAM Research (LRCX) announced a 10-for-1 stock scheduled after market close on October 2, 2024.

- In 2022, Amazon (AMZN) did a 20-for-1 stock split. At the time of the split, AMZN stock was trading well above $2,000/share.

How Does a Stock Split Affect Shareholders?

Understanding stock splits can help you make informed decisions and see beyond just the price of a company’s stock.

A stock split does not change the value of the company. If you held shares worth $10,000 before the split, you would still hold shares worth $10,000 after, just more of them at a lower price per share.

As an investor, it’s important to keep an eye on the company’s performance and not base decisions solely on the occurrence of a stock split. A stock split can be a good time to assess your investment strategy and ensure it aligns with your financial goals.