Giving back to your favorite charity does more than just feel good—it’s also a smart move for your wallet.

Finding the right charitable giving strategy can help you lower your taxes while making a significant impact on your favorite causes.

Here are a few ways to maximize the tax benefits of your charitable donations:

Donating appreciated stock

Utilizing charitable trusts

Using a Donor-Advised Fund (DAF)

Making donations from your retirement account via qualified charitable distributions (QCDs)

Each method has its advantages, both for you and for the causes you care about.

Gifting Appreciated Stock

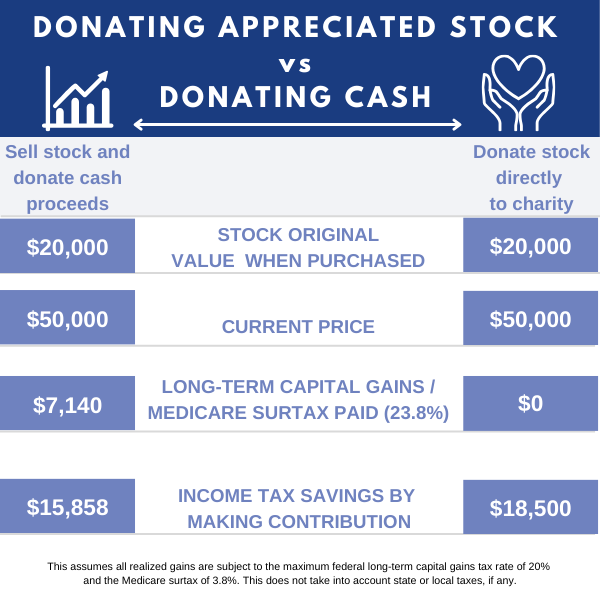

One of the most tax-efficient ways to support charitable causes is by donating appreciated stock.

This charitable giving strategy allows you to avoid paying capital gains tax on the increase in value of stocks. If you sell the stocks first, then donate the cash – capital gains would apply.

Donating Appreciated Stock – it’s a Win-Win!

Your charity of choice will receive the full market value of the stock, and you can claim a tax deduction for the same amount.

Charitable Trusts

Looking for more than just a tax break when gifting appreciated stock? Consider these charitable trusts:

Charitable Remainder Trust

Gift appreciated stock to the trust. You will receive income from the trust each year and the charitable organization will receive the remaining assets in the trust.

Charitable Lead Trust

Gift appreciated stock to the trust. The charitable organization receives income from the trust each year. Your heirs receive the assets remaining in the trust.

Donor Advised Funds (DAF)

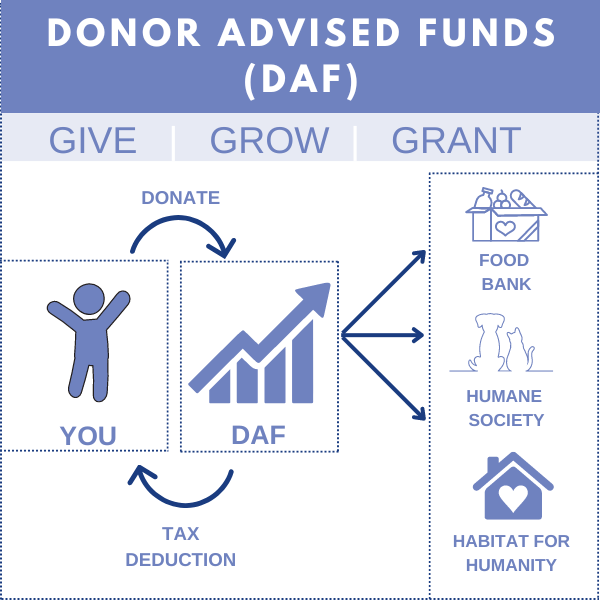

DAFs offer another strategic way to maximize your charitable impact.

DAFs offer another strategic way to maximize your charitable impact. When you contribute to a DAF, you can donate cash, stocks, or other assets and immediately receive a tax deduction for the year of the contribution, even if you decide to distribute the funds to charities over several years.

Key Reasons to Consider Using Donor Advised Funds (DAF)

Immediate Tax Benefits:

You receive an immediate tax deduction in the year you make your contribution of cash, stocks, or other assets. If you earn a considerable amount of income in a year, DAF contributions can be a great way to offset your taxable income.

Sustained Giving Over Time:

The funds in a DAF can be distributed over several years. You can make your DAF contribution now and decide later which charities will benefit, without losing the tax deduction for the current year. It’s like having a charitable savings account where your contributions can grow tax-free and then be directed as needed when the time is right.

Tax-Free Growth:

Contributions to a DAF can be invested and grow tax-free, increasing the total amount available for future charitable grants. This helps your initial donation go even further.

Streamlined Giving Process:

Managing charitable donations through a DAF is straightforward and centralized. You can contribute a variety of assets — from publicly traded stocks to real estate — and manage all your charitable giving from one platform.

When you contribute to a DAF, you’re not just donating — you’re investing in a strategy that aligns your financial planning with your philanthropic goals.

Qualified Charitable Distributions (QCDs)

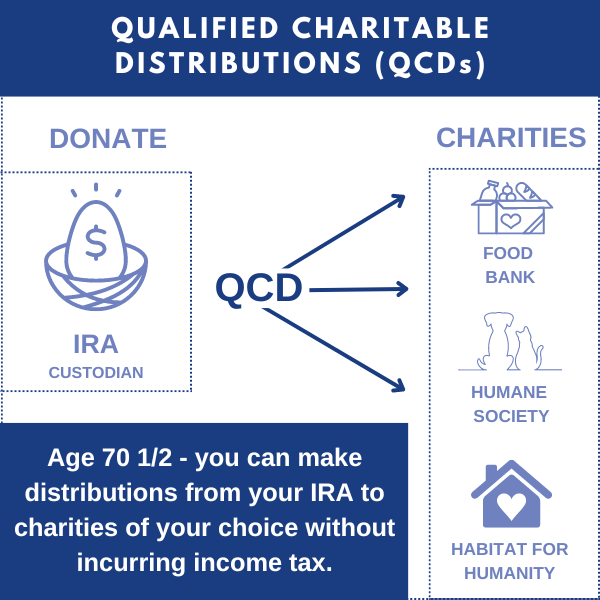

A Qualified Charitable Distribution (QCD) is a direct transfer of funds from your IRA, payable directly to a qualified charity.

If you are 70 1/2 or older with a traditional IRA, qualified charitable distributions (QCDs) present a unique giving opportunity.

Unlike regular withdrawals from an IRA, QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year, but they do not increase your taxable income.

In 2024, you can direct up to $105,000 directly from your IRA to a qualified charity.

Quality Charitable Distributions (QCDs) Benefits

Tax Efficiency: Since the QCD is excluded from your taxable income, it helps lower your annual income level.

Satisfy Required Minimum Distribution (RMD) Requirements: Regular IRA distributions are taxable and could push you into a higher tax bracket. With QCDs, you avoid this scenario, fulfilling your RMD requirements without the additional tax burden.

Fulfill Philanthropic Goals: For those who do not need their RMD for daily living expenses, a QCD offers a way to contribute to charity.

Tax-Smart Giving Strategies

Smart charitable strategies such as gifting appreciated stock, leveraging Donor Advised Funds (DAFs), and utilizing Qualified Charitable Distributions (QCDs) offer significant tax benefits while aligning your financial and philanthropic goals.

Choosing the right strategy based on your asset types and your gifting intentions can help you make a meaningful difference while optimizing your tax benefits.

Schedule time with one of our advisors to discuss what might be best for you.