So… tax season is around the corner, and you are holding crypto; what do you need to do when it comes time to file? For starters, you’ll need to check the box at the top of your 1040 if you owned, bought, or sold any virtual ‘crypto currencies’—as the IRS puts it. With prices over the last year rising through a series of volatile cycles, you might have a taxable gain. The good news is that taxes on crypto are not as complex as they may seem. The tax rate and process are like paying taxes on other financial assets, stocks, mutual funds, property, etc. you may own. The following tax information pertains best to people who invest in crypto, but keep in mind that all crypto use (including exchanges and purchases on a blockchain) subjects you to tax liability.

How is crypto taxed?

Cryptocurrency is subject to the same taxes as stocks, bonds, precious metals, and real estate.

This means that any realized capital gains from crypto transactions are going to be taxed just like realized capital gains from stocks. Like stocks, the short-term capital gains tax applies to assets bought and sold within a year, and long-term capital gains tax applies to assets sold after a year. Short-term capital gains tax can be taxed up to the top rate of 37% in 2021.

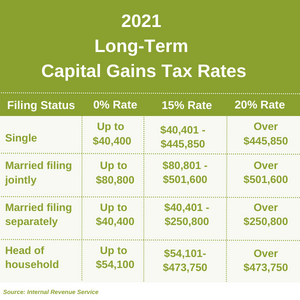

Long-term capital gain ranges from 0%-20% but can even climb to 23.8% for top income earners. Therefore, holding your crypto more than a year can shield you from higher capital gains taxes.

Additionally, starting on January 1st, 2022, in Washington State, if your capital gains exceed $250,000, you will be subject to a 7% capital gains tax on the capital gains beyond the first $250,000 on certain assets.

What is the cryptocurrency tax rate for 2021?

In order to get a glimpse of what you may owe at the federal level in capital gains tax, click here.

Keep track of your cryptocurrency gains and losses.

Despite crypto being taxed like other common assets, keeping track of your crypto gains and losses can be more difficult. Depending on where you hold your crypto, you may have to manually calculate your gains. Unlike a standard brokerage account, many crypto wallets do not provide the corresponding IRS forms you need calculate your taxes each year. If you use Coinbase, the most common custodial wallet in the US, you should receive a 1099-MISC form if you have gains over $600. However, if you own a custodial wallet or hold crypto in wallet that does not provide automated transactional service, you will need to calculate gains yourself.

Click here for a simple calculator that helps you determine your gains and losses on common cryptocurrencies. It can also be helpful to see your transaction history to ensure your calculations are accurate.

How can you be more strategic with crypto taxes?

Here are four things you can consider for tax purposes:

- Hold your crypto longer. There are a few simple steps you can take to minimize your crypto taxes. As stated before, holding crypto assets until they qualify for long term capital gains taxation (rather than short term capital gains) can potentially reduce your tax rate from 37% to 20%, or even lower depending on your income tax bracket.

- Time your sell. If you can be flexible, you can time selling your crypto in a way that enables you to qualify for a lower tax bracket. Retiring, moving to another state, going back to school, or quitting your job can all shift your levels of income and what tax bracket you are in. This in turn impacts what capital gains rate you will pay.

- Take advantage of a tax-loss harvesting. Record your losses as well as your gains. If you have been experimenting with crypto, or have bought coins at high prices, you may have lost money. Recognizing losses (tax loss harvesting) and using those losses against gains you’ve recognized in your portfolio can help reduce your tax bill. It is also important to note that wash-sale rules do not apply to crypto, meaning that you can sell crypto at a loss and buy at a similar price in a short period of time and still be able to capture the tax loss. [1]

- Make a donation to one of your favorite causes. The crypto philanthropy community is new and fast-growing! Donating crypto to a charity may reduce your tax bill. Per IRS rules, crypto donations are treated the same as cash donations and are tax-deductible[2]

Crypto is volatile, and so are the taxes that come with it.

Decentralization does not equal tax free. Both the federal and state governments are bound to make changes to the way in which crypto is taxed, particularly when and if the prevalence of crypto as an asset set class increases in the US.

However, with the information above, we hope you have a better sense of how taxes work with crypto.

Do you have questions on taxes and cryptocurrency?

Let us know if we can help you with your questions about cryptocurrency. We encourage you to reach out to our team with your specific questions