Update as of June 22, 2023

The Washington State Long-Term Care tax will go into effect on July 1, 2023. The tax applies to all WA state employees, except for individuals who received an approved exemption. The payroll tax will cost employees $0.58 per $100 of wages.

The following information comes directly from the WA Cares Fund website[1].

Automatic exemptions:

People who meet the criteria below are automatically exempt:

- Retired and non-working Washingtonians

- Federal employees who work in Washington

- Employees of tribal businesses in which the tribe has not opted in

- People who are self-employed who have not opted in

Voluntary exemptions:

Beginning January 1, 2023 people who meet the criteria below are able to apply for voluntary exemption:

- Workers whose permanent home address is outside Washington

- Temporary workers on a non-immigrant visa

- Spouses or registered domestic partners of active-duty military members

- Veterans with 70% or higher service-connected disabilities

Private Insurance Opt-Out – No Longer Available

If you purchased private a long-term care insurance policy before November 1, 2021, you were able to apply for an exemption through December 31, 2022. This window is now closed and no longer available.

If your exemption was approved, it is your responsibility to provide the approval letter to your current AND any future employers to maintain your exemption.

What happens if you cancel your private long-term care policy?

We suggest you hold on to your private long-term care policy – do not cancel it. It is unclear from the WA Cares website on how this action may affect private policy holders in the future. [2] Given the uncertainty regarding this situation and knowing the opt-out window is no longer available, you will want to maintain your private policy until more clarification about the impact to your exemption status and/or subsequent penalties comes from the state.

WA State Cares Fund – What’s Next?

The tax will fund the state’s long-term care program, WA Cares Fund. WA Cares was established to provide eligible people with a lifetime benefit of up to $36,500 to pay for nursing care or other needs as they age or become disabled.

The WA Cares program has been a subject of ongoing political debate, leaving questions unanswered regarding benefit claims and payout procedures. It is anticipated that the discussions will continue in future legislative sessions. We will continue to follow for more information.

Previous update as of January 25, 2022

The Washington state House has voted to delay the implementation of the WA Cares Fund. What does this mean for you? Here is what we know now:

- Employers will not begin withholding tax until July 1st, 2023.

- The tax has not been repealed it has been delayed. This means that if you purchased a private long-term care policy that you should not cancel it.

- There is no indication that the opt-out period will be extended. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1, 2021, you have until December 31, 2022, to opt-out of the tax. The video below will walk you through the opt-out process.

- Long-term care policies must have been purchased by November 1, 2021, to qualify for the exemption.

- If you have received your exemption letter, you should submit it to your employer ASAP.

We will continue to monitor the situation and provide updates as we learn them.

Original post:

On October 1st, the window to opt-out of Washington State’s Long-Term Care Tax opened. If you have purchased a private long-term care policy, you should start the application process soon. The website has been overwhelmed with visitors. We suggest you visit it during off-hours (early morning, late evening, or the weekend). Some of our own employees have attempted to go through the process and have experienced challenges simply because the website cannot handle all the traffic. Good news is that with some perseverance a few of us have had success in navigating through the process.

We have outlined a step-by-step guide and created a video on the topic to help you with the opt-out process.

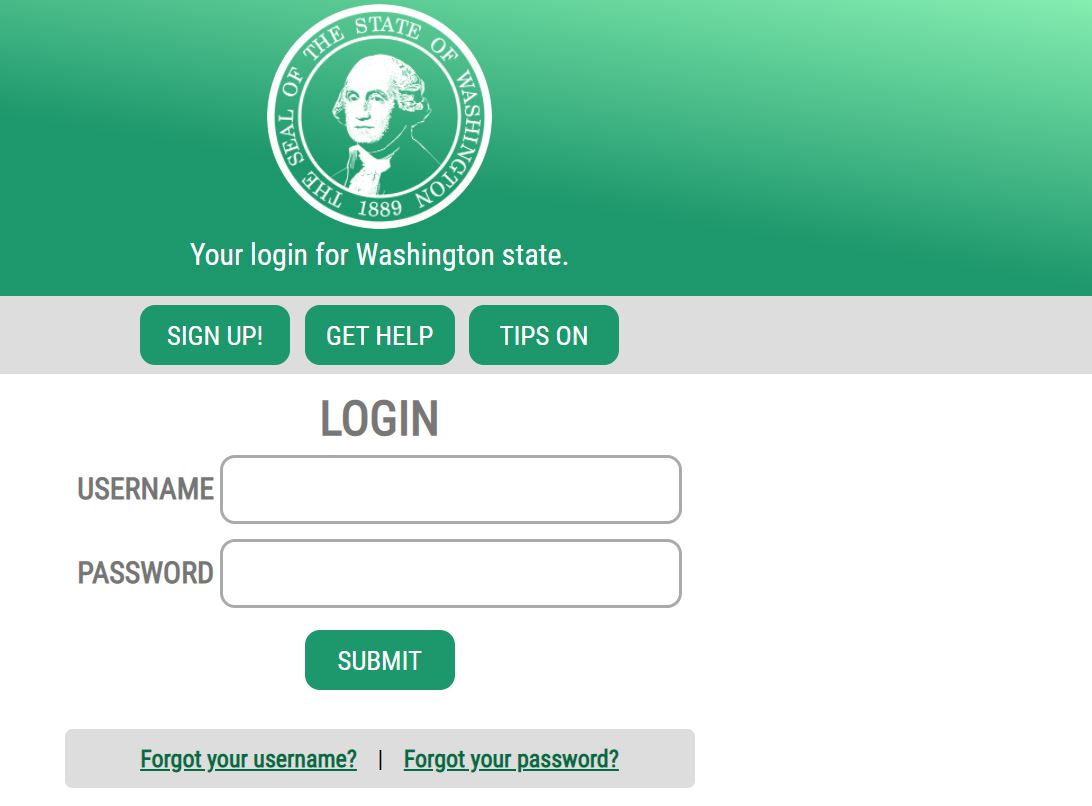

Step One: Create a SecureAccess Washington (SAW) Account

Visit: https://secureaccess.wa.gov/myAccess/saw/select.do and select the “Sign Up” button. If you already have an existing SAW account, enter your information and hit submit.

After entering your first and last names and your email address, you should receive an email with a link to activate your account. Once your account is active, you’ll need to add “Paid Family and Medical Leave” to your SAW services.

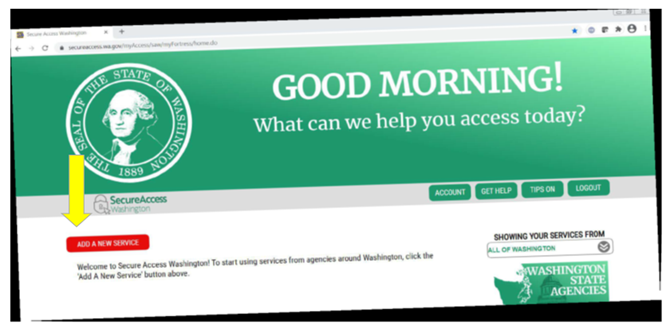

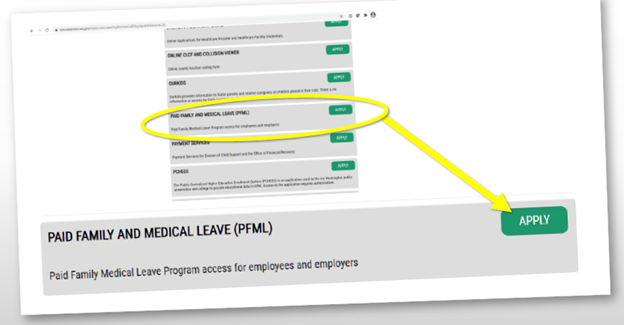

Step Two: Add Paid Family and Medical Leave to your SAW services

Log-in to your SAW account at secureaccess.wa.gov,

Select “Add A New Service”

Select “I would like to browse a list of services”

Scroll through the list to “Employment Security Department” and select “Paid Family and Medical Leave” from the drop-down menu.

When you see the confirmation screen that lets you know the service has been added to your list, click “OK”, then select “Paid Family and Medical Leave” from your list of services to access your account.

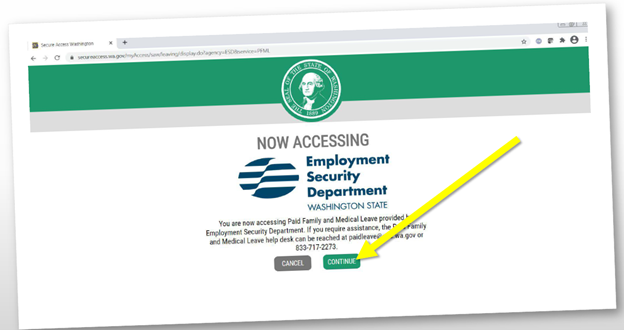

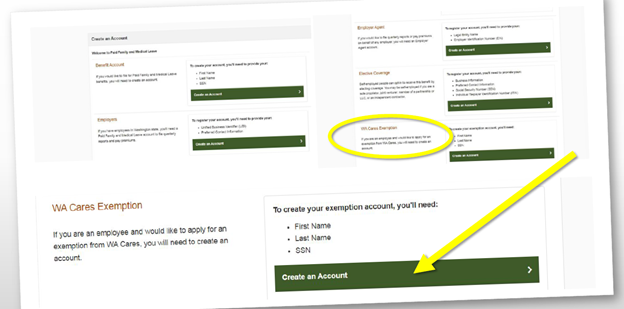

Step Three: Create Your Exemption Account

Once you’ve logged in and selected Paid Family and Medical Leave from your list of services in SAW, you’ll click “Continue” to proceed to creating your WA Cares Exemption account.

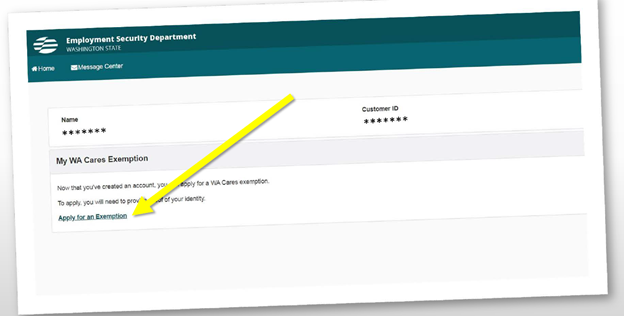

Under My WA Cares Exemption, click on Apply for an Exemption

On the “Create an Account” page, select the “Create an Account” button to the right of “WA Cares Exemption”.

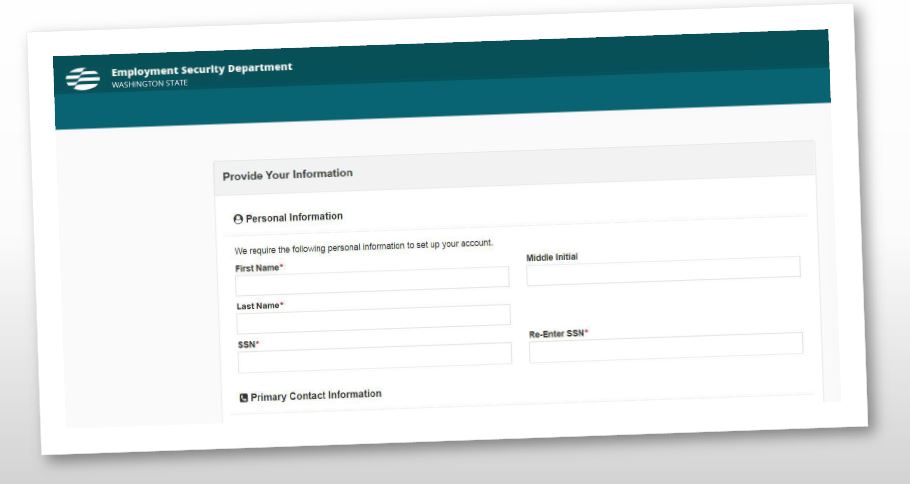

Complete the necessary information to create you exemption account

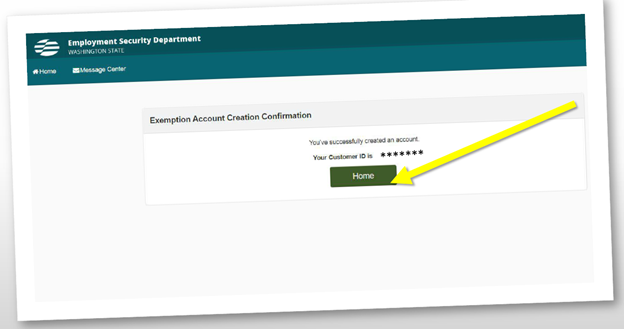

Upon completion you’ll receive a “customer ID”

Step Four: Apply for Your Exemption

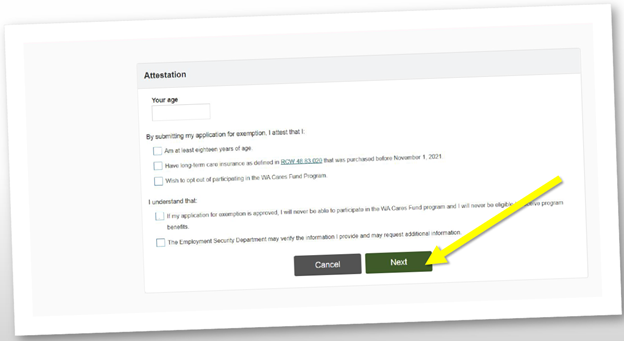

Enter your current age

Attest that you are:

- At least 18 years of age

- Have long-term care insurance purchased before 11/1/2021

- Wish to opt-out of participating in the WA Cares Fund Program

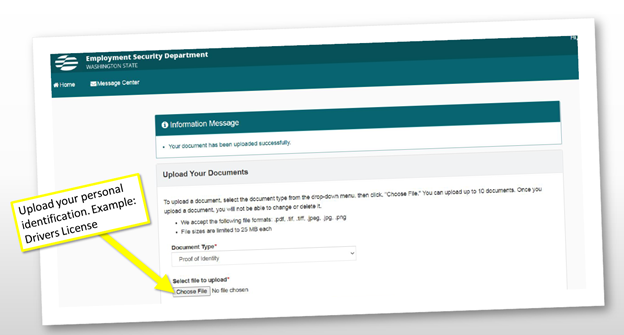

You may need to upload proof of identity if you have not done so in the past under the Secure Access WA system.

You have Submitted Your Application – What’s Next?

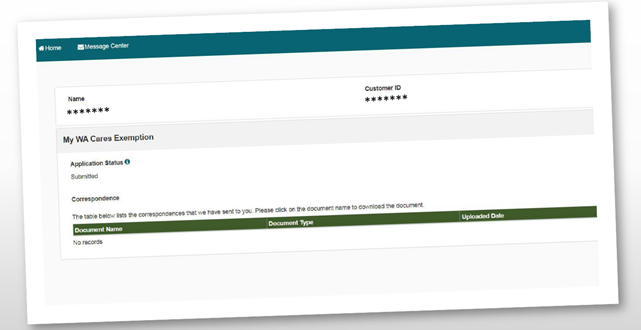

To see the status of your application

- Under the Paid Family and Medical leave area click on Access Now

- Hit Continue

- Your application status will be listed, and any correspondence the state has sent to you

Final Step – Provide Exemption Approval to Employer

If your application is approved, you’ll get an exemption approval letter from ESD, at which point you’ll be:

- Expelled from the program with no option to re-enroll.

- Disqualified from accessing WA Cares benefits in your lifetime.

- Required to present your exemption approval letter to all current and future employers.

Present your exemption approval letter to all current and future employers! The exemption will take effect the quarter after your application is approved.

If you fail to present your ESD approval letter, employers will withhold NON-REFUNDABLE WA Cares premiums.