The WA Long-Term Care Trust Act (The WA Cares Fund)

Updated as of June 22, 2023

The Washington State Long-Term Care tax will go into effect on July 1, 2023. The tax applies to all WA state employees, except for individuals who received an approved exemption. The payroll tax will cost employees $0.58 per $100 of wages.

The tax will fund the state’s long-term care program, WA Cares Fund. WA Cares was established to provide eligible people with a lifetime benefit of up to $36,500 to pay for nursing care or other needs as they age or become disabled.

WA Cares Fund Exemptions

The following information comes from the WA Cares Fund website[1].

Automatic exemptions: People who meet the criteria below are automatically exempt:

- Retired and non-working Washingtonians

- Federal employees who work in Washington

- Employees of tribal businesses in which the tribe has not opted in

- People who are self-employed who have not opted in

Voluntary exemptions: Beginning January 1, 2023 people who meet the criteria below are able to apply for voluntary exemption:

- Workers whose permanent home address is outside Washington

- Temporary workers on a non-immigrant visa

- Spouses or registered domestic partners of active-duty military members

- Veterans with 70% or higher service-connected disabilities

Private Insurance Opt-Out – No Longer Available

If you purchased private a long-term care insurance policy before November 1, 2021, you were able to apply for an exemption through December 31, 2022. This window is now closed and no longer available.

If your exemption was approved, it is your responsibility to provide the approval letter to your current AND any future employers to maintain your exemption.

What happens if you cancel your private long-term care policy?

We suggest you hold on to your private long-term care policy – do not cancel it. It is unclear from the WA Cares website on how this action may affect private policy holders in the future. [2] Given the uncertainty regarding this situation and knowing the opt-out window is no longer available, you will want to maintain your private policy until more clarification about the impact to your exemption status and/or subsequent penalties comes from the state.

WA State Cares Fund – What’s Next?

The WA Cares program has been a subject of ongoing political debate, leaving questions unanswered regarding benefit claims and payout procedures. It is anticipated that the discussions will continue in future legislative sessions. We will continue to follow for more information.

Previous Update | January 25, 2021

The Washington state House has voted to delay the implementation of the WA Cares Fund. What does this mean for you? Here is what we know now:

- Employers will not begin withholding tax until July 1st, 2023.

- The tax has not been repealed it has been delayed. This means that if you purchased a private long-term care policy that you should not cancel it.

- There is no indication that the opt-out period will be extended. If you meet the opt-out criteria and purchased your LTC policy prior to November 1, 2021, you have until December 31, 2022, to opt-out of the tax. We produced a video that walks you step-by-step through the process . Long-term care policies must have been purchased by November 1, 2021, to qualify for the exemption.

- If you received your exemption letter don’t forget to submit it to your employer.

We will continue to monitor the situation and provide updates as we learn them.

Original post : June 23, 2021

Did you know that beginning on January 1, 2022, employers will be required to collect a payroll tax on all compensation for every W-2 employee in Washington? If you work for one of Washington’s large tech employers – Amazon, Microsoft, Google, Facebook, etc. and make more than $300,000 you will want to learn how this new tax might impact you.

This new payroll tax will be used to fund a state run, long-term care insurance program for Washington citizens, named The WA Cares Fund. If you earn income in Washington as a W-2 employee, you will be impacted by this new tax. The one way to become exempt from this tax is by opting out.

So, let’s take a deeper look into The WA Cares Fund and whether or not it makes sense to opt out.

What is the WA Cares Fund?

Washington State has enacted the nation’s first public, state-run, long-term care insurance program (The WA Cares Fund). This program will provide up to $36,500 in lifetime benefits for eligible Washingtonians, which can be used to supplement costs associated with long-term care (LTC). Providing a LTC benefit to all eligible Washingtonians sounds like a nice gesture, however, many perceive that the payroll tax is mainly intended to alleviate the burden of the state funded Medicaid system, which costs are projected to double by 2030.

Who is Eligible for Benefits?

People who are eligible[1] for long-term care can begin applying in January 2025. You must be at least 18 years old and a resident of Washington state. To qualify for benefits you must have worked and met these contribution requirements:

- You have worked at least ten years at any point in your life without a break of five or more years within those ten years, or

- You have worked three of the last six years at the time you apply for the benefit and

- At least 500 hours per year during those years

What is the Benefit?

Individuals can receive up to $100/day to cover long-term care costs. There is a maximum lifetime benefit of $36,500. There are some things to consider about this benefit:

- Benefits aren’t available outside of the state of Washington

- Benefits only cover the employee who contributed through payroll. Family members (spouse / dependents) are not eligible.

How is it Funded?

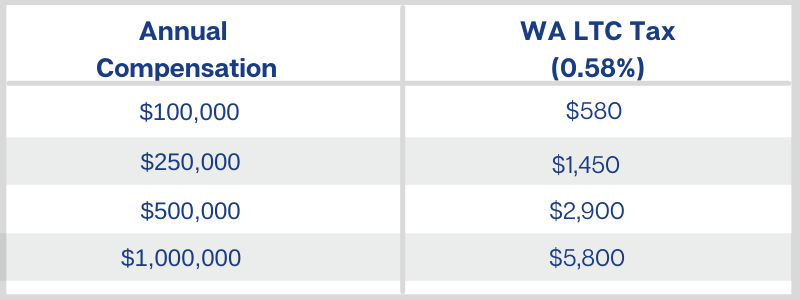

Beginning on January 1, 2022, employers will be required to collect a 0.58% tax on ALL compensation of W-2 employees. So, for every $100 you earn (salary, bonus, stock, etc..) 58 cents will be deducted from your paycheck. Self-employed individuals are not subject to the tax but can opt-in if they choose.

What Types of Compensation are Subject to WA LTC Tax?

Forms of compensation include, salary, bonuses, stock grants, PTO, severance pay, etc. For the many Microsoft, Amazon, Google, Salesforce, and other tech employees in our state, stock grants (RSUs) make up a significant proportion of their total compensation. As stock grants vest, the market value is taxed and reported as ordinary income, meaning your stock compensation is subject to the tax.

Lastly, there is no cap or income thresholds. So, if you do not opt-out of the WA Cares Fund, every dollar you earn will be taxed at 0.58%. To put it into perspective, we can look at a few examples:

How to Opt Out of Washington’s Long-Term Care Trust Act

In order to opt out of the tax, you are required to have your own Long Term Care policy in place, with equal or better benefits, by November 1, 2021. Beginning October 1, 2021 until December 31, 2022, you must submit an attestation to the Washington State Employment Security Department to receive an official opt-out letter. You then provide this letter to your current or any future employer, to avoid having the tax deducted from your compensation.

As of now, there is only one opt-out period. You must apply between 10/1/2021 – 12/31/2022. The policy must be in place prior to November 1, 2021.

Should You Opt Out?

Here are some questions to ask yourself and consider when deciding if it may make sense to opt-out:

Do you plan to retire within the next 10 years?

To qualify you must have worked and contributed to the fund for:

- At least 10 years without a break of five or more years within those 10 years, or

- 3 of the last 6 years at the time you apply for the benefit

Are you planning to retire elsewhere?

Benefits are not available outside of WA

Do you want coverage for a non-working spouse?

Benefits only apply to the contributing employee

Are you a high earner/dual-income household?

You most likely can find an overall better policy at a lower cost than your estimated annual tax

Are you a young worker?

The lifetime benefit is $36,500 – If you work for another 20-30 years, how much will you have paid into the fund?

Do you need LTC Insurance?

Will your future earnings/savings allow you to be “self-insured?”

Are you currently self-employed but may return to the workforce as a W-2 employee?

There is only one opt-out period

Who Should Consider Not Opting Out?

Everyone’s situation is different, but there are two main reasons for not opting out:

- Existing health conditions prevent you from purchasing a LTC policy on your own

- Low/Average income earner – The potential benefit is greater than the lifetime tax

Final Thoughts on Washington’s Long-Term Care Trust Act

The average cost for facility care is between $70k to $130k a year. The maximum lifetime benefit of The WA Cares Fund is $36,500 ($100 daily benefit). Depending on the type and length of care needed, the state benefit will most likely cover only a fraction of the actual cost. On top of that, you need to consider how much you will pay into the fund over your lifetime and is the potential benefit worth your tax dollars.

If you think your situation warrants paying into the fund, then nothing needs to be done. If you want to opt-out of the tax, you have one chance to do so. The application and underwriting process can take a few months and insurance providers in WA are already dealing with an influx of applications.

We are happy to talk through your financial situation, please schedule some time with one of our Advisors about how Washington’s Long-Term Care Trust Act might impact you.