Meta 401(k) and Mega Backdoor Roth

Avier Wealth Advisors is not affiliated with Meta. While Avier communicates with its clients regarding their Meta employee benefits, and educates itself on the Meta Benefits, there is no guarantee that the information we have provided is accurate. Meta employees are encouraged to contact their employer should they have any questions regarding their specific employee benefits.

Your Meta 401(k)

You Can Contribute More in 2025

The Meta 401(k) is a retirement savings plan that allows you to invest a portion of your salary into long-term investments to save towards retirement.

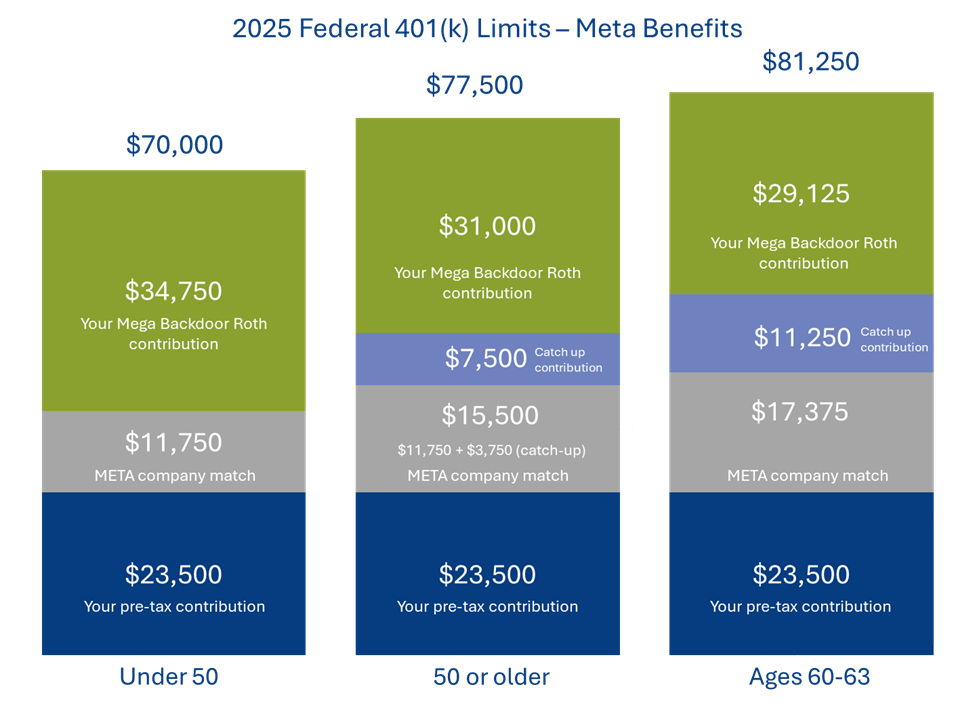

In 2025 you can contribute:

- Employees under 50 years old can contribute up to $23,500

- Employees who are 50+ can contribute up to $31,000 ( $23,500 + $7,500 catch-up contribution)

- Employees who are between 60-63 can contribute up to $34,750 ($23,500 + $11,250 super catch-up contribution)

Meta 401(k) Match

Meta will match $1 for $1 of your 401(k) contributions, up to 50% of the IRS federal limit of your compensation deferrals:

- Employees under 50 years old can earn up to $11,750

- Employees 50+ can earn up to $15,500. Meta will match $1 for $1 of your catch-up contribution up to 50% of the IRS federal limit. This is an additional $3,750 on top of the $11,750.

- Employees between 60-63 can earn up to $17,375. Meta will match $1 for $1 of your super catch-up contribution up to 50% of the IRS federal limit. This is an additional $5,625 on top of the $11,750.

401(k) Contribution Options

You can make your 401(k) contributions on a traditional pre-tax or Roth basis. The difference between each comes down to when you pay taxes.

Traditional Pre-Tax 401(k) – Pay Taxes Later for Potential Future Savings

Make your contributions before taxes. Contributions do not count as taxable income, reducing your taxable income for that year. When you withdraw savings for retirement, the withdrawals are taxed as ordinary income.

Roth 401(k) – Pay Taxes Now. Your Withdrawals are Tax-Free in Retirement

Make your contributions after taxes. You will not reduce your taxable income for that year. When you withdraw savings for retirement, you will not pay taxes on the withdrawals.

People typically find themselves in a lower tax bracket when they retire, making pre-tax contributions to a 401(k) more attractive during working years – especially for high-income earners.

Meta Mega Backdoor Roth

The Mega Backdoor Roth is a provision within your Meta 401(k).

It allows you to contribute after-tax dollars to your 401(k), up to the IRS federal limit, and convert those dollars to Roth.

In 2025, the IRS federal limits for 401(k) contributions are:

- Under 50: $70,000

- 50 or older: $77,500

- Between 60-63: $81,250

Fully Leverage Your Meta Mega Backdoor Roth

Max Out Pre-Tax Contributions

You can contribute the maximum 2025 pre-tax amount of $23,500 (under 50), $31,000 (if you’re 50+), or $34,750 (between 60-63) to your 401(k) before making after-tax contributions to the Mega Backdoor Roth.

Earn Your Full Employer Match

When you max out your Meta 401(k), you’ll earn the full employer match. The 2025 match is $11,750 (under 50), $15,500 (if you’re 50+), and $17,375 (between 60-63).

Make After-Tax Contributions

Meta allows you to contribute up to the federal limit of $70,000 (under 50), $77,500 (if you’re 50+), and $81,250 (between 60-63). The result is an additional $34,750 in after-tax dollars to your 401(k) if you’re under 50, $31,000 if you’re 50 or older, and $29,125 if you’re between 60-63.

Convert After-Tax Dollars to Roth

The key advantage of the Mega Backdoor Roth is that you can immediately convert your after-tax contributions to Roth within your Meta 401(k). This means:

- Your Roth contributions will grow tax-free.

- You may be able to withdraw your contributions tax-free in retirement, potentially saving thousands in taxes.

Meta Mega Backdoor Roth Benefits

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth. When you fully leverage the features of your Meta 401(k) you benefit from:

Tax-Free Growth

Within a Roth your money grows tax-free. These same dollars, and the interest earned, can be tax-free when accessed in retirement.

Increased Retirement Savings

You can save significantly more in your retirement account. In 2025 you contribute up to the federal limit of $70,000 ($77,500 if you’re 50 or older, or $81,250 if you’re between 60-63).

Tax Diversification

You can create a balance of pre-tax and Roth savings towards your retirement. This can provide you with more flexibility for the types of withdrawals you can make during that time.

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.