Nike Employee Benefits

Avier Wealth Advisors is not affiliated with Nike. While Avier communicates with its clients regarding their Nike employee benefits, and educates itself on the Nike Benefits, there is no guarantee that the information we have provided is accurate. Nike employees are encouraged to contact their employer should they have any questions regarding their specific employee benefits.

How Do I Maximize My Nike Employee Benefits in 2025?

As your career evolves at Nike, your salary increases and stock awards compound. Your benefits can help you realize financial security when leveraged correctly.

We know how busy you are and value your time. We help you optimize your equity compensation, reduce taxes, and plan for your long-term goals.

Navigate Your Nike Benefits and Compensation

Understanding Your Nike Compensation

Nike employees are compensated in 3 different ways:

BASE SALARY

This is very straight-forward, your base salary is paid out bi-weekly.

ANNUAL CASH BONUS

The Performance Sharing Plan (PSP) bonus day is highly anticipated by Nike employees.

Qualifying employees are typically rewarded 5% – 30% of their annual pay in one lump sum.

STOCK GRANTS

Your equity compensation comes in two forms. You may elect to receive Restricted Stock Units (RSUs) and/or Non-Qualified Stock Options (NSOs).

Stock Awards

Restricted Stock Units vest 25% over 4 years.

Employees who are granted RSUs will receive 25% of their vest in year one and another 25% in year two, year three, and year four. This vesting schedule can create a cascade of RSUs to manage due to the addition of new vesting RSUs each year.

Typically, employees let their stock awards accumulate in their investment accounts.

When your RSUs vest, it’s basically the same as Nike giving you cash – only the cash comes in the form of RSUs. With thoughtful planning you can sell these shares at the time they vest and use the proceeds for your day-to-day living expenses.

There are a couple of reasons to consider using this strategy. First, it helps you maintain a diversified portfolio and avoid building up a concentrated position of NKE stock with embedded capital gains. And second, it can free up cash from your salary to allocate towards your 401(k), Mega Backdoor Roth, and Deferred Comp Plan.

Your Nike 401(k) and Employer Match

The Nike 401(k) allows employees to invest a portion of their salary into long-term investments and save for their retirement.

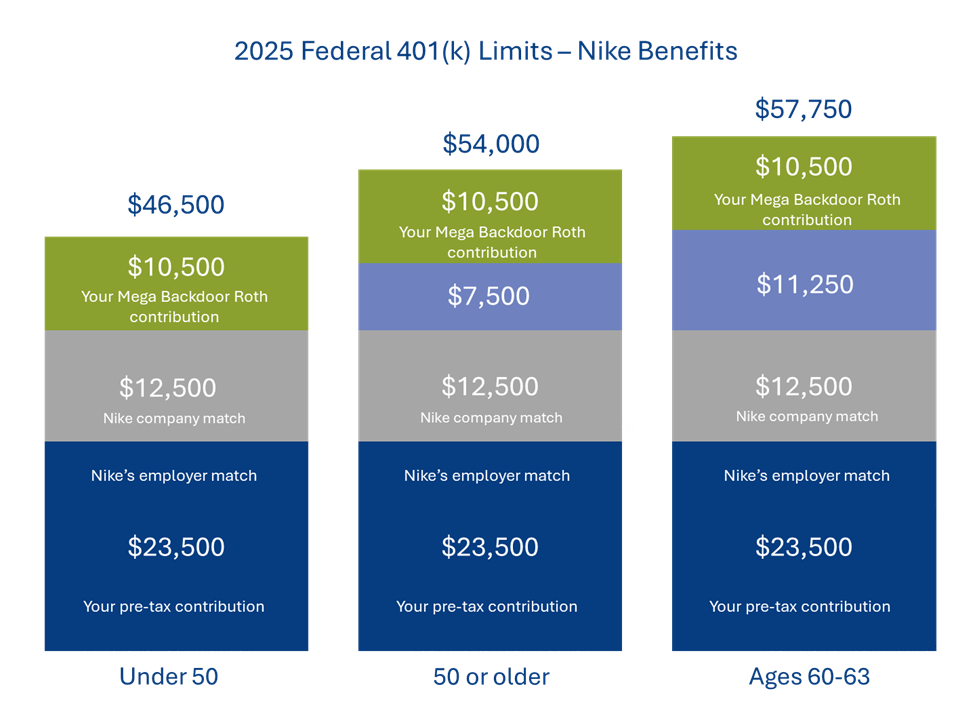

2025 401(k) Contribution Limits

- Under 50: $23,500

- 50 and older: $31,000 ( $23,500 + $7,500 catch-up contribution)

- Between 60-63: $34,750 ($23,500 + $11,250 super catch-up contribution)

How Much is Nike’s Employer Match?

Nike will match 5% of your annual salary. To receive the match, you must contribute at least the same amount.

Make sure you are contributing at least 5% of your salary to ensure you receive the match from Nike. This is free money. Make sure you prioritize this benefit over all other Nike benefits.

Nike Mega Backdoor Roth

The Mega Backdoor Roth allows you to save even more for your retirement and reduce some of your future tax liabilities. This provision within your 401(k) enables you to contribute after–tax dollars to your 401(k). You can convert these dollars to a Roth.

In 2025, Nike allows you to contribute 3% of your annual salary to the Mega Backdoor Roth, up to $10,500

The Mega Backdoor Roth is often under-utilized and overlooked. We explain this benefit in more detail in our 2024 blog, “The NIKE Mega Backdoor Roth: How does it Work?

Nike’s Deferred Compensation Program

Deferred compensation is an opportunity to save and invest dollars on a pre-tax basis.

Eligible employees can defer:

- Up to 75 of their annual salary.

- Up to 100% of their PSP Bonus for the following year, bonus deferrals must be made at least 18 months before payout.

Contributions to your Deferred Compensation Program reduce taxable income in the year of the deferral and can be invested into a selection of investment options. Deferred compensation can help reduce your tax bill by thousands.

EMPLOYEE STOCK PURCHASE PLAN

The Nike ESPP enables employees to purchase Nike stock at a 15% discount.

Your contributions to this program come from payroll deductions, much like your 401(k) contributions. However, unlike pre-tax 401(k) contributions, ESPP contributions are taken out on an after-tax basis.

Employees can designate up to 10% of their eligible compensation with a lesser of 500 shares or $25,000 per year.

The first runs from April 1st through September 30th and the second window goes from October 1st through March 31st. Your price is the better of a 15% discount off the offering price or a 15% discount from when you purchased it. You can sell these shares immediately, or you can wait for 2 years and sell when they would qualify as long-term capital gains.

OTHER BENEFITS

CHARITABLE GIVING

Employees can utilize the Give Your Best platform to help their donations go even further. Nike and the Nike Foundation match donations to schools and charitable organizations up to $25,000 per year, per employee. And when employees volunteer, they receive a $10 credit per hour, up to $2,500 per calendar year, to donate to their cause of choice.[1]

HEALTH SAVINGS ACCOUNT

Nike offers its employees the option to enroll in a Health Savings Account (HSA). The HSA comes with three significant tax benefits: contributions are tax-free, money grows tax-deferred, and you can withdraw money tax-tree if the funds are used for qualified medical expenses.

Latest Articles About Your Nike Benefits

Your Nike Stock Decision: Restricted Stock Units and/or Stock Options?

Nike employees may receive stock options or restricted stock units (RSUs) as part of their compensation package.Nike employees deciding on their annual stock award can choose between Nike stock options (NSOs) and restricted stock units (RSUs). Understanding the...

4 Nike Employee Benefits to Prioritize

As a Nike employee you have access to a wide range of benefits that will help you save for retirement, provide financial security, and when leveraged correctly reduce taxes. It may feel overwhelming to figure out which ones to prioritize, so we have compiled a list of...

The Nike Mega Backdoor Roth: How Does it Work?

2024 Updates for the Nike Mega Backdoor RothConvert After-Tax Dollars to a Roth Nike employees can contribute thousands to a Roth using the Mega Backdoor Roth provision within the Nike 401(k). The Mega Backdoor Roth allows you to contribute after-tax dollars to your...

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.