Many high-income earners in Portland and Multnomah County—Oregon’s most populous county—are getting (or will soon get) a rude awakening upon opening their paychecks. Besides paying their usual Federal and State of Oregon income taxes, higher income earners are doing the heavy lifting to pay for the region’s new social programs.

Last November, voters in Multnomah County passed the county’s “Preschool for All” ballot measure. Starting in 2022, the tax will provide tuition-free preschool for 3- and 4-year-olds and raise the pay of preschool teachers in a community that is increasingly looking like a childcare desert. This is no doubt welcome relief to working parents struggling to meet the high cost of childcare and childcare providers. Moreover, many studies show huge returns on investing in early child education.

Another program takes aim at Portland’s acute homelessness crisis. Any Rose City local will attest to how serious homelessness has become in the last few years. Passed in May 2020, Metro’s “Supportive Housing Services” measure provides a combination of low-cost housing, rent assistance, and shelter beds as well as healthcare and employment services in Multnomah, Clackamas, and Washington Counties.

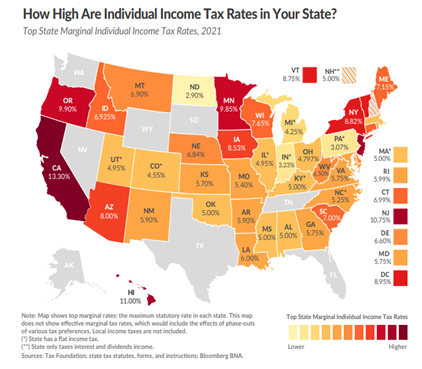

While these seem like well-intentioned programs, it’s always easier to spend other people’s money. And for many taxpayers, it’s starting to feel like death by a thousand cuts. Oregon already has one of the highest state income tax rates at 9.9%.

To fund “Preschool for All,” single filers earning over $125,000 are paying 1.5%, while those making above $250,000 are paying 3%. Joint filers are paying 1.5% for income over $200,000 and 3% when their income exceeds $400,000. This measure automatically increases rates by 0.8% in 2026. For Metro’s Homeless Services measure, single taxpayers earning over $125,000 and couples earning more than $200,000 are on the hook for an additional 1% on income above these thresholds.

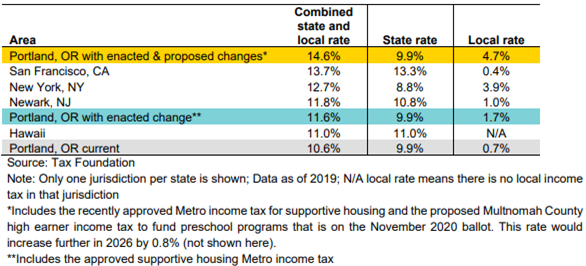

So, how does this compare to other metropolitan areas? A recent article in Willamette Week drawing on data from Ernst & Young pointed out that residents making more than $250,000 pay the highest personal income taxes in the country, hitting a combined effective marginal rate of 14.6% in state and local taxes.

The highest state and local individual income tax jurisdictions in the US with Portland’s proposed and enacted tax changes incorporated into the rankings. Top marginal rates in 2019 plus new rate changes.

Thinking of moving out of Multnomah County or Metro to avoid the tax hit? Not so fast. Residents of nearby counties or even income-tax-free Washington State who work in Portland or Metro are also on the hook for the tax, despite not voting on the measure. As one Clackamas County resident who wasn’t eligible to vote on the childcare measure recently said, “It’s taxation without representation.”

The best way to keep a little bit more in your pocket is to maximize your income deferrals. This means contributing as much as possible on a pre-tax basis to your retirement plan, such as 401(k) or 403(b) plans, and opting for a high-deductible health insurance plan instead of a low-deductible, high-cost plan. Some employees at Intel and Nike, among others, can also take advantage of company deferred compensation plans to put aside additional dollars today, tapping into them in retirement. Cash flow planning and understanding one’s spending needs in retirement are critical steps for optimizing these plans.

If you have questions on how to leverage your company benefits to help reduce your tax bill, please schedule time on my calendar to discuss.