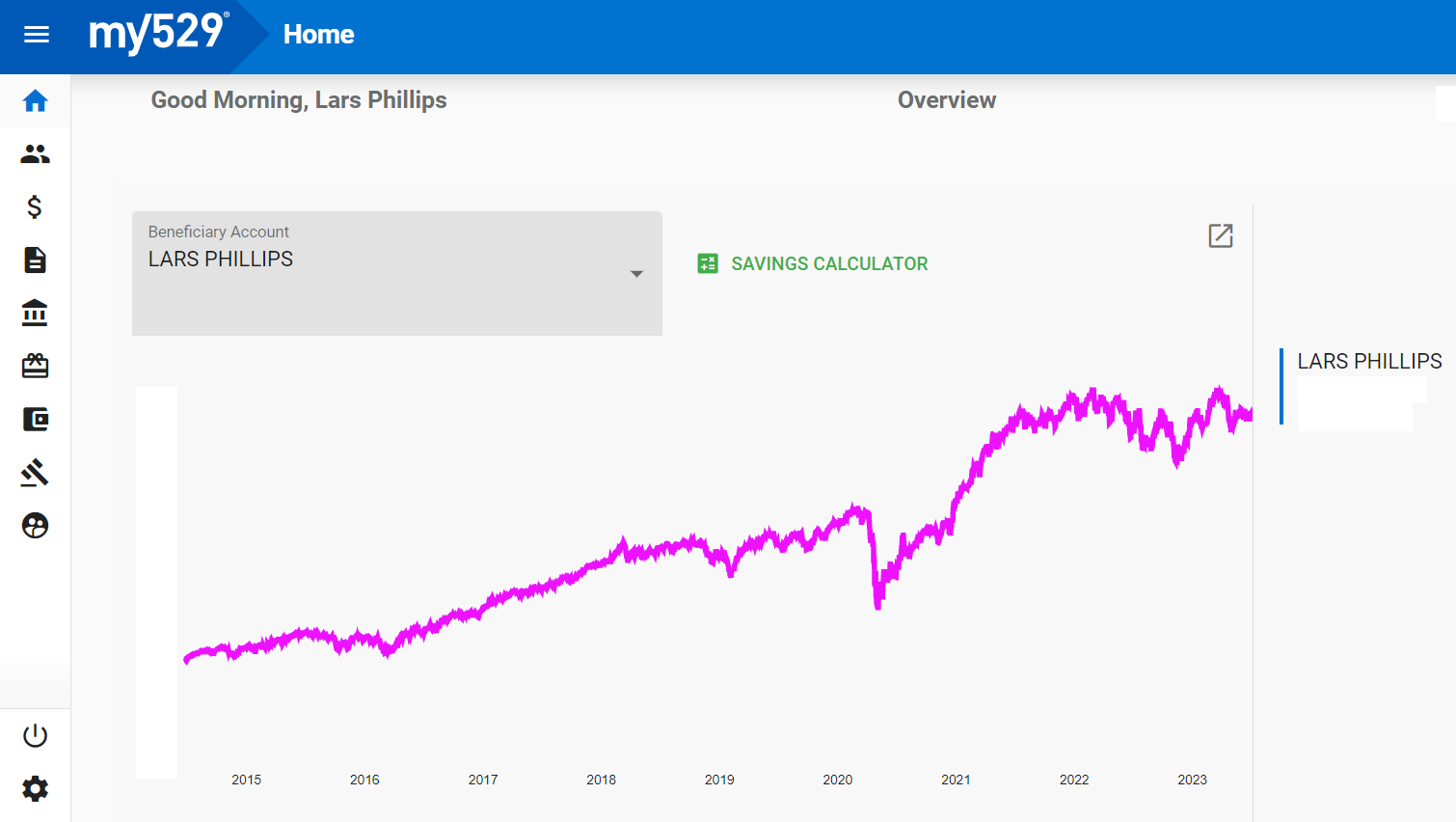

As a single 26-year-old in 2014 I established a 529 College Savings Plan for a kid I didn’t have with a gal I had yet to meet. While life circumstances are not terribly different today from when they were back then – there’s a two-part reason as to why I wanted to get a head start on 529 planning.

Reason Number 1: Setting up a 529 plan and automating savings to the account is in my eyes, the most important 30 minutes you can spend to impact the life of a younger family member or loved one. You’re setting aside money for education and doing so takes Ron Popeil levels of simplicity.

Automate Your 529 Plan Savings Strategy

In less than 30 minutes you can:

- Set up an account

- Name your beneficiary

- Set your age-based investment allocation target

- Automate contributions to the account (this part is key)

If this was all you did – if you truly “Set it and forget it” – these 30 minutes alone could make covering college costs so much easier down the road.

529 Plan Overview

You may have an idea as to how a 529 plan works and if you don’t, here’s a very quick primer. You can set money aside in an account that’s designated for qualified educational expenses for a beneficiary. There are exceptions to the rule, but for most people this means college expenses for a child or grandchild. These dollars grow tax free, which means more money for college and less money for the government.

529 Plan Flexibility

Unlike and UGMA or UTMA where your child or grandchild ends up with full control over the funds at a certain age and could hypothetically blow it all on a sports car – with a 529 account, you the owner maintain full control. This leads to all kinds of flexibility!

Kid gets a full ride scholarship? Sweet – you can adjust the account beneficiary to a different kid, or even a grandkid. (In my case, I’ve named myself as beneficiary with the idea of updating my beneficiary to my kid in future.)

Child ends up not using all of the 529 plan funds you have set aside for them? No problem – with the new SECURE ACT 2.0 you can now use these funds to help them start saving into a Roth IRA (there are rules around this, but it’s a spectacular new provision for overfunded accounts.)

Life circumstances dictate that you actually need to use the money for yourself? Not a worry – you’ll only owe taxes and a 10% penalty on the gain within the account.

Why Did I Want a Head Start on 529 Planning?

Reason Number 2: Education is super important and is a core value I want to impart on any of my future children. Sure, an extra 10 years of compounding and growth within the account will help monetarily, but more importantly (and yes, I realize this is a bit of a flex) to be able to tell a future child “I think higher education is so important, I started saving for your college more than 10 years before you were even born” will hopefully get the point across.

Should I Start a 529 Plan?

The answer to this question is not a simple yes or no. It depends on your situation. For me, it’s a part of how I invest my money, and it was something I wanted to do for my future child. There are benefits of starting a 529 Plan early, both for you and your child – even if that child isn’t part of your immediate future.