Mega Backdoor Roth

In 2024, you can potentially contribute thousands to a Roth using the Mega Backdoor Roth provision within your 401(k).

The Mega Backdoor Roth allows you to contribute after-tax dollars to your 401(k) and convert those dollars to Roth.

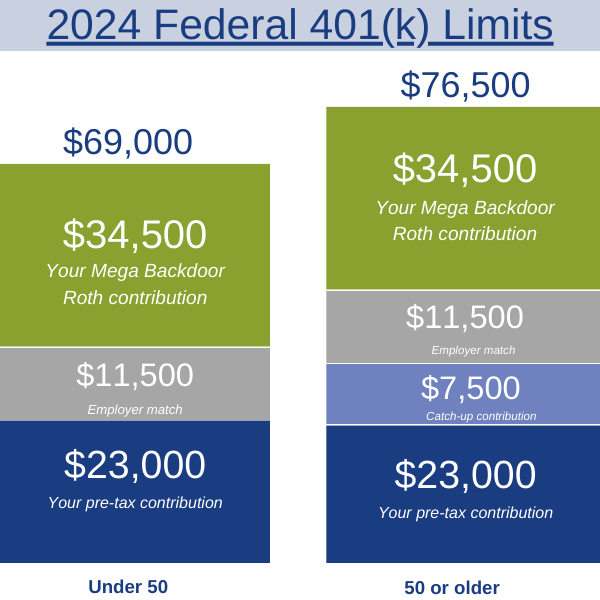

The 2024 federal limits for 401(k) contributions are:

- $69,000 if you’re under 50

- $76,500 if you’re 50 or older

The Mega Backdoor Roth is available at companies like Microsoft, Amazon, Meta, Nike, Intel, Google, VMware, Boeing, and others.

We have several different videos to help you understand how this benefit works at specific companies. If you’re unsure whether your company offers this benefit, your HR department can let you know.

The Mega Backdoor Roth allows you to invest thousands to a Roth

In traditional 401(k) plans (pre-tax or Roth) you are limited to how much you can save into your retirement account.

In 2024 if you are:

Under 50, the contribution limit for a 401(k) is $23,000.

50 or older the annual limit increases by $7,500 for a total of $30,500.

If your 401(k) plan includes the Mega Backdoor Roth provision, you can contribute thousands of after-tax dollars to Roth.

There are two eligibility requirements for the Mega Backdoor Roth 401(k). Your 401(k) plan must allow the following:

After-tax contributions to your 401(k)

In-plan Roth conversion

Mega Backdoor Roth Example

Under 50 Years Old

To illustrate how much in after-tax contributions you can make, we’ll walk through two examples. In this example, we will assume your employer allows you to contribute up to the federal limit.

Most employers contribute some sort of match to an employee’s 401(k) plan. In this example, we assume your employer match is 50% and you are maxing out your 401(k) contribution.

Your 401(k) contribution: $23,000

Your employer match: $11,500

The pre-tax contribution and employer match equal $34,500. Our example employee has not reached the federal limit of $69,000. This means they can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

Using the Mega Backdoor Roth provision, you can contribute up to $34,500 in after-tax dollars and convert those dollars to Roth.

50 Years Old or Older

For someone who is 50 or older, the federal limit increases. In the second example below, our employee makes the following contributions and earns the full employer match:

401(k) contribution: $30,500

401(k) catch-up contribution: $7,500

Employer match: $11,500

For someone 50 or older, the federal limit for 401(k) contributions is $76,500. This means our example employee can contribute up to $34,500 in after-tax dollars and immediately convert those dollars to Roth.

Roth Conversion Rules

Pay attention to the Roth conversion rules in your plan. Some plans will do the conversion for you automatically, some are more manual.

Automatic Roth Conversions: For plans with this feature, you may see a dropdown on the contribution section within your 401(k)that allows you to state you want to convert these dollars as soon as possible.

Manual Roth Conversions: You might have to reach out to your 401(k) provider and ask them to convert these dollars for you and request they set up automatic conversions on a go-forward basis.

Mega Backdoor Roth Tax Benefits

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth.

- Within a Roth your money grows tax free.

- These same dollars, and the growth, are tax free when accessed in retirement.

- Having a bucket of retirement assets that can be distributed tax free, provides for greater control of the income you realize and your resulting tax bill throughout retirement.

The Mega Backdoor Roth is One of the Best Benefits Available

If you are on track to max out your 401(k) in 2024 and your company offers the Mega Backdoor Roth Conversion, this is a benefit worth learning more about.