A liquidity event, such as an IPO or acquisition, is a huge accomplishment for any business.

It is extremely satisfying to see your hard work pay off. Yet, as exciting as this time may be – it also brings a lot of questions regarding what’s next. Now more than ever you need a thoughtful financial plan that encompasses your long-term financial and personal goals. Here are a few questions you may want to consider:

How will this impact my family and my lifestyle?

Do you want to retire or continue to work? Are you going to need money for education expenses for your children or family? Are you considering a new home / 2nd home? What organizations are you passionate about, would you like to make an impact financially?

Now is the time to begin speaking with a trusted advisor who can help you develop a financial plan with your goals and your family’s needs at the center.

Who do I need on my team?

Assembling a team of financial professionals can help you feel less anxious.

- Financial Advisor: Your advisor will construct a diversified portfolio that aligns your short and long-term goals and help you develop a cash-flow plan that enables you to maintain your current lifestyle and plans for future income.

- CPA: You should start planning for a liquidity event as soon as you can to help reduce the taxes you will owe now and in the future. Your CPA, advisor, and estate planning attorney will work together to develop a strategic plan to help you mitigate taxes.

- Estate Planning Attorney: What is the legacy you want to leave for your family? Are you charitably inclined? What organizations and causes do you care about? Establishing a well-thought-out estate plan allows you to maintain control over how you distribute, protect, gift, and retain your assets for the long term.

What tax planning strategies should I consider?

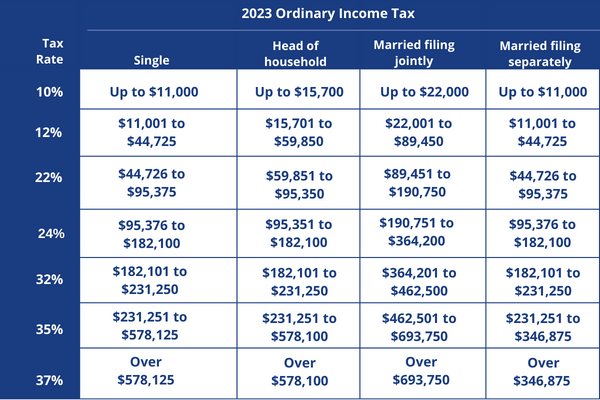

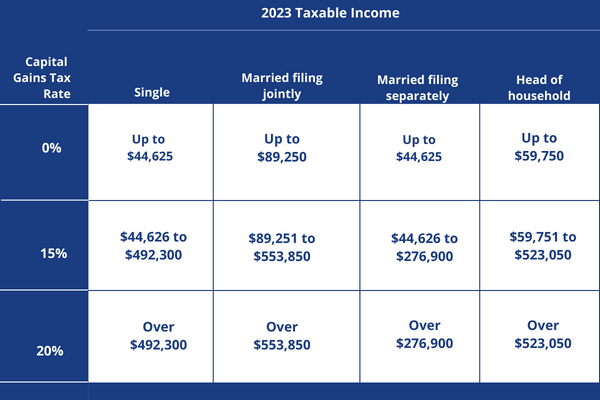

There are going to be tax consequences to consider during a liquidity event. You will want your financial advisor and tax professional to identify strategies for minimizing taxes. In the year the event occurs, you will want to understand what is subject to ordinary income tax and what is subject to long-term capital gains.

Ordinary Income Tax 2023

Long-term capital gains tax rates for the 2023 tax year

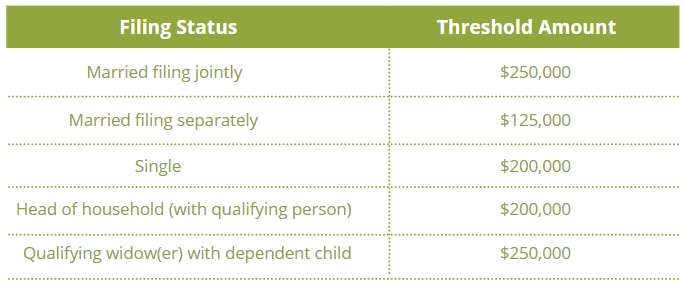

Your capital gains may be subject to the Net Investment Income Tax (NIIT), an additional levy of 3.8 percent to individuals, estates and trusts that have income above the statutory threshold amounts.

What are strategies for giving back?

Donor Advised Funds (DAF)

If you are charitably inclined, a Donor Advised Fund will help you maximize your giving. You can receive the tax benefit of a donation if you make an investment in your DAF the year the liquidity occurs. A DAF allows you to decide how you want to invest your contribution, which will grow tax-free. When you are ready to donate, you make the grant from the DAF. Keep in mind, money in a DAF is irrevocable and must be used for charitable donations.

Working with a philanthropic planning professional

Your philanthropic plan is a representation of who you are and what you care about, it goes beyond what you establish in your estate plan. You should think about what you would like to accomplish with your giving. How much control do you want over your contributions? How involved are you currently or wish to be with the organization? Working with philanthropic planning professional who can support your charitable efforts and assist with researching the organizations you want to support will help provide peace of mind about the legacy.

What should you do if you experience a liquidity event?

We have outlined some of the more common financial, tax, and wealth transfer strategies, however, your needs are unique. The best plan is the one that is focused on you and your family’s personal and financial long-term goals.

This is an exciting time for you, and we know you probably have questions, our team is here to be a resource for you. We encourage you to schedule time to discuss your goals.