Does this New Law Apply to You?

You may have recently heard about a new tax ruling that applies to capital gains in Washington state.

The news about this ruling may have left you wondering what the capital gains tax is and whether it applies to you.

If you receive equity compensation and are not selling your shares as they vest you could potentially create a situation where you are exposing yourself to the Washington Capital Gains Tax.

What is in the New Law?

Washington state recently passed a law that imposes a 7% tax on the sale of long-term capital assets.

This tax applies to assets like stocks and bonds if the gain exceeds $250,000 per year for an individual (the standard deduction is limited to $250K whether you file joint or separate returns).

This law was recently challenged in court but was ultimately ruled Constitutional by the Washington State Supreme Court with a 7-2 vote.

Overview of How Capital Gains Work?

Capital gains tax is assessed when you sell assets, such as stocks or bonds, for more than you paid for them. If you sell an asset for more than you purchased it for, you have a capital gain. Capital gains tax applies to the difference between what you paid for the asset and what you sold it for.

Let’s Walk Through an Example

While this may sound alarming, it’s important to understand that this new tax is unlikely to affect most tech professionals in Washington.

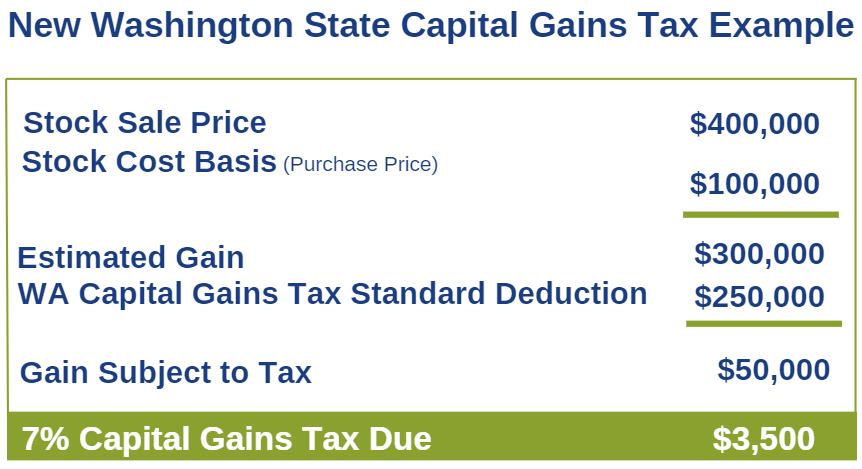

For example, let’s say you sold $400,000 worth of stocks in a given year, and you purchased those stocks for $100,000. Your capital gain is $300,000.

This means you exceed the $250,000 standard deduction for capital gains tax by $50,000. You are only taxed on the amount exceeding the deduction. The capital gains tax due would be $3,500 (7% of $50,000).

Capital Gains Tax Only Applies to Certain Types of Assets

Another important note about the capital gains tax is that it only applies to gains from the sale of certain types of assets, and not all assets (such as real estate) are subject to capital gains tax.

Additionally, there are some ways to mitigate capital gains, such as through charitable donations, and tax-loss harvesting.

The New Law is Unlikely to Affect Most People

The threshold for the capital gains tax is relatively high at $250K of gain; we anticipate that many investors will be able to navigate the tax with ease.

However, it will be important to work with your Advisor and CPA to understand the impacts of transitions out of large, concentrated positions.

If you have questions about the new law and its impact on you and your financial plan, schedule a time with one of our advisors.