Microsoft Employee Benefits

How Do I Maximize My Microsoft Employee Benefits in 2024?

As your career evolves at Microsoft, your salary increases and stock awards compound. Your benefits can help you realize financial security when leveraged correctly.

We know how busy you are and value your time. We help you optimize your equity compensation, reduce taxes, and plan for your long-term goals.

Navigate Your Microsoft Benefits and Compensation

Key Dates

Stay informed and on track with key dates and details around your Microsoft benefits and compensation package. Click the button below to view the timeline.

Q1 : JANUARY – MARCH

JANUARY

Review 401(k) Contributions

- Update 401(k) contribution percentages to reflect new tax laws

- Adjust for increases in salary and September bonus

- Confirm after-tax contributions with in-plan Roth conversion benefit

- Increase contributions due to the catch-up provision (Age 50+)

FEBRUARY

MSFT Stock Awards

- Sell and diversify vested shares

- Determine investable amount and reserves for cash needs

MARCH

MSFT ESPP

- Sell ESPP shares at the end of

the quarter

Q2: APRIL – JUNE

MAY

MSFT Stock Awards

- Sell and diversify vested shares

- Determine investable amount and reserves for cash needs

Deferred Compensation Election

- Identify deferral amount for following year’s cash bonus

JUNE

MSFT ESPP

- Sell ESPP shares at the end of the quarter

Q3: JULY – SEPTEMBER

JULY

Review 401(k) Contributions

- Confirm contributions are on pace to max out benefits

- Review and adjust allocation if needed

AUGUST

MSFT Stock Awards

- Sell and diversify vested shares

- Determine investable amount and reserves for cash needs

SEPTEMBER

MSFT ESPP & Employee Reviews Completed

- Sell ESPP shares at the end of the quarter

- Cash bonus and new MSFT stock awards are received

- Download new stock grants and vesting schedules

Q4: OCTOBER – DECEMBER

NOVEMBER

MSFT Stock Awards

- Sell and diversify vested shares

- Determine investable amount and reserves for cash need

Life Insurance and Health Plan Review

Deferred Compensation Election (Level 67+)

- Identify deferral amount for following year’s salary

Charitable Giving Review and Tax Loss Harvesting

DECEMBER

MSFT ESPP

- Sell ESPP shares at end of the quarter

Understanding Your Microsoft Compensation

Your Microsoft compensation package contains several components: base salary, annual cash bonuses, on-hire cash bonus, and stock awards (on-hire and annual).

BASE SALARY

Your consistent monthly income, paid twice a month.

ANNUAL CASH BONUS

Annual cash bonuses are paid out in September; these typically range between 0% to 40% of your eligible salary but can go higher.

ON-HIRE CASH BONUS

New hires may receive a one-time cash bonus within the first 30-60 days of employment. This bonus may be delivered in a single payment or as two installments.

STOCK AWARDS

There are two main types of stock awards: On-hire stock awards and Annual stock awards. Typically, each award comes with a unique vesting schedule.

Your Microsoft Restricted Stock Awards

Restricted Stock Units (RSUs)

Stock awards can make up a significant portion of total compensation for many Microsoft employees. There are two main types of stock awards:

On-hire stock awards: You receive these when first joining Microsoft as an incentive to join the company. The shares vest over a 4-year period.

Annual stock awards: You may receive these awards upon being hired, as part of your annual compensation package, or as a special award.

RSUs become available to you as they vest over time. As the stock shares vest, you are taxed at ordinary income tax rates based on the total value of the vesting shares of stock.

Most RSUs vest quarterly starting in February (which you can remember using the acronym FMAN: February, May, August, November). These stocks vest at the end of each month.

Microsoft’s Review awards (similar to “Refresher” awards at other companies) follow this schedule.

Eligible employees may receive Special Stock Awards. The vesting schedule for these shares vary from other RSUs you receive. These awards vest mid-month in March-June-September-December.

Supplement Cash Flow Using Your Restricted Stock Units

As a Microsoft employee you receive Restricted Stock Units which can be sold once they vest.

With careful financial planning you can sell these shares and use the proceeds for your monthly expenses. This can free up cash from your salary to allocate towards your 401(k) and Mega Backdoor Roth.

Your Microsoft 401(k) Basics and Employer Match

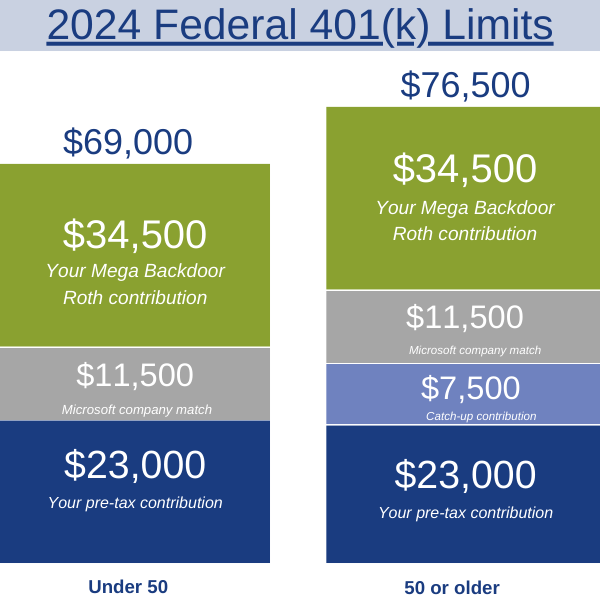

Your 401(k) contributions increased in 2024.

- If you’re under 50 you can contribute up to $23,000

- If you’re 50 or older you can contribute up to $30,500 ($23,000 plus a $7,500 catch-up contribution)

These contributions can be made on a traditional pre-tax or Roth basis.

Microsoft Employer Match

Microsoft will match 50% of your 401(k) contributions, this means you can earn up to an additional $11,500 in free money in 2024.

We encourage you to make the most of this benefit by maxing out your 401(k) contributions before utilizing any other benefits available to you.

Understanding the Microsoft Mega Backdoor Roth

In 2024, the total contribution limit for a 401(k) plan is $69,000 if you’re under 50 and $76,500 if you’re 50 or older to your Microsoft 401(k).

This limit applies to all sources of contributions, including employee, employer match, and catch-up contributions.

You can fully leverage these limits by taking advantage of the Mega Backdoor Roth – a powerful benefit within your Microsoft 401(k).

Contribute Thousands to a Roth

The Mega Backdoor Roth feature of the Microsoft 401(k) allows you to contribute after-tax dollars, up to $34,500 in 2024, and automatically convert those dollars to Roth.

The Mega Backdoor Roth is a way for high-income earners to utilize the benefits of a Roth.

Within a Roth your money grows tax-free. These same dollars, and the growth, are also distributed tax-free when accessed in retirement. Having a bucket of retirement assets that can be distributed tax-free, provides for greater control of the income you realize and your resulting tax bill throughout retirement.

The Microsoft’s Deferred Compensation Plan (DCP)

Reduce Taxable Income

Microsoft Deferred Compensation Plan (DCP), exclusive to Level 67+ employees, offers a powerful tax-reducing opportunity.

Deferring income into your DCP reduces your taxable income in the year of deferral. Your contributions can be invested into a selection of investment options.

DCP works similarly to a pre-tax 401(k) plan. It is an opportunity to save and invest dollars on a pre-tax basis.

You can enroll in DCP 2 times a year:

May 1 – 31: Elect to defer up to 100% of next year’s September bonus.

November 1 – 30: Elect to defer up to 75% of your salary.

Other Benefits

Charitable Giving

Double the donation! Microsoft matches gifts to qualified charitable organizations made by employees dollar-for-dollar, up to $15,000!

Increase your impact for the causes that matter most to you by leveraging this benefit. If you’ve already made charitable gifts, you can submit requests for Microsoft to match gifts made anytime in the last 12 months.

If you are heavily concentrated in MSFT stock, and/or have old shares with low basis, consider gifting these low-basis shares to charities instead of cash for tax-efficient diversification.

Health Benefits

Microsoft offers its employees the option to enroll in a Health Savings Account (HSA).

The HSA comes with 3 significant tax benefits: contributions are tax-free, money grows tax-deferred, and you can withdraw the money tax-free if the funds are used for qualified medical expenses. And, once you reach age 65, you can use your HSA dollars for any reason without penalty, only paying ordinary income taxes. Essentially, turning your HSA into a pre-tax retirement account, like a traditional IRA or 401(k).

Life Insurance & Other Coverage

For healthy individuals, outside plans may be more advantageous and for high net worth individuals, a combination of the Microsoft group plan and an outside plan may be necessary to ensure desired coverage.

MORE MICROSOFT INSIGHTS

For more information and advice from our Microsoft-focused advisors, visit our main Microsoft page, our Microsoft Compensation and Miscellaneous Benefits page, our Microsoft Deferred Compensation Page, or our Microsoft RSU and ESPP page.

LATEST ARTICLES ABOUT YOUR MICROSOFT BENEFITS

You’ve Been RIFed by Microsoft – Now What?

If you’re reading this, there’s a good chance you’ve recently been impacted by a Reduction in Force (RIF) at Microsoft. First off, we’re sorry you’re going through this – it’s a tough, emotional time filled with uncertainty. But we’re here to help guide you through...

Should You Participate in Microsoft ESPP?

The Microsoft Employee Stock Purchase Plan (ESPP) allows Employees to purchase Microsoft Stock at a Discounted Price ESPP is a popular benefit that many employees want to participate in. However, with so many benefits available, how does the Microsoft ESPP compare...

Promoted to Level 67 at Microsoft?

Now that you have been promoted to Level 67 at Microsoft, you're eligible to participate in the Microsoft Deferred Compensation Plan (DCP). Why is this so significant? DCP provides you with an incredible opportunity to reduce your tax bill by deferring a portion of...

READY TO GET STARTED?

Focused on your needs, we provide comprehensive financial planning and investment advisory strategies for individuals and families. We’d love to hear from you.